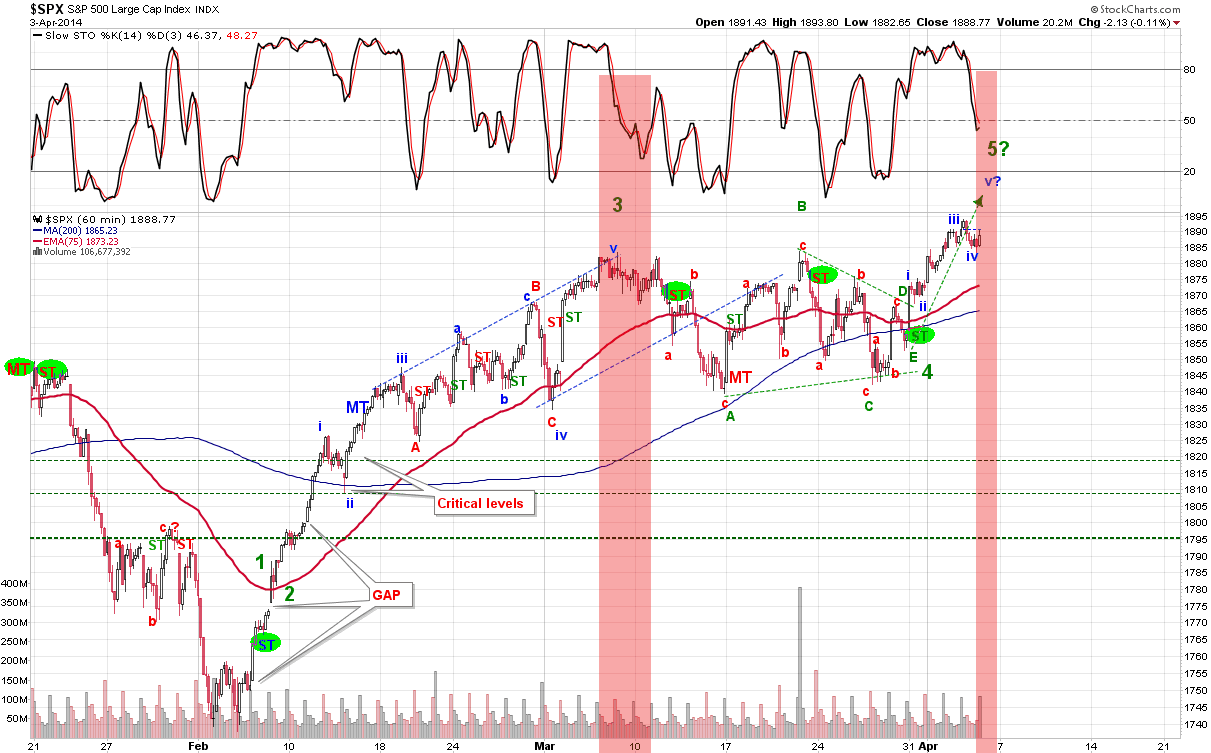

We are now entering the potential CIT range, and prices are still looking strong for the uptrend. The EW counts has not changed but aside from the count we must be careful at a possible top here. We are at overbought and would need for indicators to reset back down for us to be comfortable with any long side position. The weekly candle bar looks bullish at this stage and would need for us tomorrow to reverse substantially for bears, and CIT to have a chance. If we don't then the bullish case extends to next week.

MT: DOWN

ST: UP

PA: UP

tmr job number is important

ReplyDeleteFor a bearish reversal weekly candle, the scenario would be to have a spike high but end down that gives a long tail or wick to the candle. So the Jobs number might come out good and spike then drop as talks of rates rising or acceleration of taper might scare everyone off. Im not saying this would happen but it is possible. We could also have the reverse and have a bad jobs number and spike because of prolonged QE, but then everyone would realise that its not sustainable for Feds to continue purchasing and have rates remain at zero. So there is always two sides to the story of the bear which have the same outcome. This is why fundamentals fail in my books.

ReplyDeleteim on the bear side of miners, fingers crossed

ReplyDelete