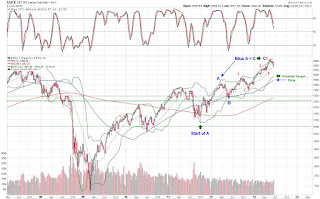

The rally today after a brutal morning was said to be from Hilsenrath talking. Meanwhile our intra-day indicators at this low was oversold and turning positive even before he spoke. It was also the stopping point for the weekly 20ma. Going back to yesterdays analysis I mentioned that the 75ma had to be broken for bears to run. It was, and today prices managed to reach up to the 75ma only to be turned back down. This week has closed again to another bearish tone and still far away from being oversold. We should see this coming week as it will be an important week and end of month. At the moment 1631 is the monthly open that if crossed would still keep the bullish candle alive which has been on trend for 7 months. This bearish monthly candle so far looks good to print the month in bear mode, and possibly push the monthly stoch. out of the overbought range for the first time since February 2012.

Mid-Term: DOWN

Short-Term:DOWN

Seems there was a break of the lower trend line critical to the Canadian dollar. Line draw might not be as accurate but one thing for sure is the tail has pierced through. A confirmation would accelerate the Looney downward. Target breakdown was 1.5 months early as you can see below.

Keeping an eye on ur thoughts, thanks for sharing

ReplyDeleteThanks...

Delete162x

ReplyDeleteand we go down again

you could be right would be looking to have that gap filled at the least.

Delete