I can't believe that we are already writing our last post for 2013. Time has passed by fast this year, and it has been a great time as well. I would like to thank the ever growing viewers of this site, and encourage you to make my blog a must read blog daily. I always try to keep things simple and understandable for traders with basic or advanced principles.

I hope that 2014 not only brings volatility, but also brings large profits for everyone in our small community.

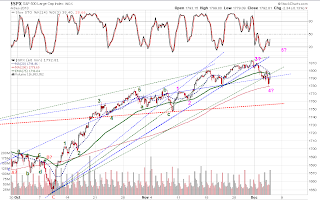

Today we saw higher prices as indicated from yesterdays update. We are tagging our upper angle again and seems to follow its time and price. Looking at the time calculator, there seems to be a Jan 8 / Jan 12 date sticking out as a possible CIT (change in trend). This is based on the Sq. of 144 calculator of 1768 and 1772 days from the 2009 lows. Not sure if I am doing this calculation right but it is interesting nonetheless.

Going back to the basics, we do see a negative divergence forming in the intra-day charts. We would still need to see our MT and ST trends to exit the overbought situation for us to see a sustained run to the downside. We are only 11 pts away from our minimum target of 1860 from todays high and 31 pts away from our extended range of 1880 SPX.

MT: UP

ST: UP

Happy New Year !!!

“Those who have knowledge don’t predict. Those who predict don’t have knowledge.”

Lao Tzu, Chinese philosopher, 6th century BC

PAYPAL

Tuesday, 31 December 2013

Monday, 30 December 2013

GANN SQUARE SUPPORT / RESISTANCE UPDATE

Are we seeing a possible support now for the 1830 SPX level? The ES movement sideways seems to suggest it, and although the SPX has not come close to the 1830 level, it has been moving identically sideways as well.

There is a suggestion that the SPX could possibly top out at 1860 - 1880. This would put 1860 in the resistance area of the 120 Deg. angle using the 60 Deg. overlay.

The number is highlighted in purple to show where it falls.

Friday, 27 December 2013

27 Dec 2013

It seems there is no stopping this acceleration. Everyday is met with higher highs in prices, and only stops at each resistance angle we draw. Today brought us a reactionary date from ICE cycles, but as expected, there was not much activity since everyone is still on the holiday mood and not checking the markets.

MT: UP

ST: UP

MT: UP

ST: UP

Tuesday, 24 December 2013

24 Dec 2013

No commentary tonight, but will leave you with a chart that shows prices have hit another one of our angles again.

MT: UP (Unconfirmed)

ST: UP

MT: UP (Unconfirmed)

ST: UP

Monday, 23 December 2013

23 Dec 2013

Many are off on vacation, but prices still remain in an uptrend. Low volume or not, markets are still working their magic. I believe in an intra-day basis that there is another stab higher before we move lower. We will assess how or what type of move down, when we get to that stage.

Before I continue, I would like to say that SPX 1830 is on the 135 Deg. of the Gann Sq. of 9 chart. Usually a nice resistance / Support. In this case, it would be a resistance, how much remains to be determined. The chart below shows 183 which I multiplied by 10 so I don't have to expand to such a big graph.

Todays high of 1829.75 proves there is resistance just above it.

MT: UP (Unconfirmed)

ST: UP

Before I continue, I would like to say that SPX 1830 is on the 135 Deg. of the Gann Sq. of 9 chart. Usually a nice resistance / Support. In this case, it would be a resistance, how much remains to be determined. The chart below shows 183 which I multiplied by 10 so I don't have to expand to such a big graph.

Todays high of 1829.75 proves there is resistance just above it.

MT: UP (Unconfirmed)

ST: UP

Friday, 20 December 2013

20 Dec 2013

We had our higher high. The question now becomes "is this it?" or will it only be the 1st wave of that 5th wave. ES seems to be making another wedging pattern, and we know what happened to the last wedge that formed. That said, trends are still in favour of the upside so we should not jump into any conclusions.

MT: DOWN

ST: UP

MT: DOWN

ST: UP

Thursday, 19 December 2013

19 Dec 2013

Prices was sporting a sideways pattern. Looks as though it will break that high made in early Dec. once it resumes a continuation.n Prices are following one of the underside of the angle, but pattern suggest a 4th wave of some kind.

MT: DOWN

ST: UP

MT: DOWN

ST: UP

Wednesday, 18 December 2013

18 Dec 2013

Our abcde scenario yesterday was on the dot. We had an impulsive move up following the wedge which is typical behaviour just right after the pattern. We should watch for a new high and watch for a 5 wave pattern to produce itself. I believe that based on the cycle chatter out there that the 5 waves could complete somewhere near mid January. So keep this date in mind.

Todays price action just blew by all the angles that I have drawn in the past. This suggest that there are optimism everywhere. Never base your analysis on news.. Why? Well a few months ago a Taper was bad news and any talk of it dropped markets. Todays decision however came with a surprise Taper... and what do you know markets rallied. "It's all about time folks".

MT: DOWN

ST: UP

Todays price action just blew by all the angles that I have drawn in the past. This suggest that there are optimism everywhere. Never base your analysis on news.. Why? Well a few months ago a Taper was bad news and any talk of it dropped markets. Todays decision however came with a surprise Taper... and what do you know markets rallied. "It's all about time folks".

MT: DOWN

ST: UP

Tuesday, 17 December 2013

17 Dec 2013

Prices did retrace today according to yesterdays analysis. The intra-day charts seem to show a potential of a wedge / abcde EW pattern. Both of which is a bullish sign. The bearish case scenario is that we have 1-2 1-2 count that could potentially setup a 3rd wave down in a minute degree. A lower low tomorrow for the SPX would give us a possibility of a positive divergence. So we must keep this option open. There is the lower trend line of the wedge connecting blue a and blue c. This could be the support where it would meet the red dotted line.

MT: DOWN

ST: UP

MT: DOWN

ST: UP

INTRA 17 Dec 2013

Seems we might have an ABCDE pattern that is forming a wedge at the same time. This could be a clue to higher highs.

Monday, 16 December 2013

16 Dec 2013

Last Friday I mentioned that I believe that there is more downside due to the corrective pattern made previous days before. Although todays price moved up, the price in the ES did make a significant low overnight just before the market opened today. I do not know what this tells us, whether the move is done or if the SPX would catch up to the lows. But after todays pop, prices started to move sideways again. Therefore the bias is on an intra-day upside, while our Main and Short term trend remains down.

MT: DOWN

ST: DOWN

MT: DOWN

ST: DOWN

Friday, 13 December 2013

13 Dec 2013

It is my belief that we are in a Holding pattern and that the corrective phase is not over. I do believe that next week should see us moving lower before we move higher. That said, it seems to me that the Head N Shoulder pattern is the one to follow. Targets for this measured move should be within the 1760 to 1750 range. I mentioned yesterday that the daily lower BB line was pierced and that any move to the downside can only be sustained if the prices relieve itself by a pause or rally before proceeding lower. So far so good I guess.

MT: DOWN

ST: DOWN

Be aware that the Daily Stoch. has reached oversold levels. This is usually where to go short and not the other way. The entrance into overbought or oversold usually keeps price at an accelerated or impulsive mode.

MT: DOWN

ST: DOWN

Be aware that the Daily Stoch. has reached oversold levels. This is usually where to go short and not the other way. The entrance into overbought or oversold usually keeps price at an accelerated or impulsive mode.

Thursday, 12 December 2013

12 Dec 2013

Todays continued break down shows the strength of this impulse, and can either be summed up as a throw over or a continued push towards the 1750 zone. This 1750 zone represents 161.8% of the green assumed A wave from B to C. The intra-day stochastics might make a negative divergence so we should watch for this as a clue to a possible turn up.

We have also pierced the bottom of the BB line on a daily chart. Therefore anything below this is not sustainable short-term and a correction is needed to alleviate the extreme if we are to continue moving down. Alternatively, we can place a 3rd wave on the Green C Wave as a more bearish approach.

MT: DOWN

ST: DOWN

We have also pierced the bottom of the BB line on a daily chart. Therefore anything below this is not sustainable short-term and a correction is needed to alleviate the extreme if we are to continue moving down. Alternatively, we can place a 3rd wave on the Green C Wave as a more bearish approach.

MT: DOWN

ST: DOWN

Wednesday, 11 December 2013

11 Dec 2013

Our short-term trend has turned down and a 5 wave pattern looked to have formed. This either a C wave or a 1st wave of a secondary degree. If this is a C wave, then it is most likely a C wave of a 4th and we should see the higher high that I am expecting. We should see in the next day or two what the patterns come out as before we can make a call. But if this is not satisfactory then the indicators are as good as they get.

A head and shoulder pattern from last Fridays analysis is still valid. Therefore, we must watch for this possibility.

MT: DOWN

ST: DOWN

A head and shoulder pattern from last Fridays analysis is still valid. Therefore, we must watch for this possibility.

MT: DOWN

ST: DOWN

11 Dec 2013 INTRA-DAY

The Trend has changed for the short-term and is inline with the weekly. We would have to go with the down-trend if we close today with both indicators to the downside.

Main-Trend: DOWN

Short-Term: DOWN (Unconfirmed)

Main-Trend: DOWN

Short-Term: DOWN (Unconfirmed)

Tuesday, 10 December 2013

10 Dec 2013

Yesterdays corrective process had not ended based on todays move. That said, I think that prices for the SPX is still on its way upwards.

Main-Trend: DOWN

Short-Term: UP

Main-Trend: DOWN

Short-Term: UP

Monday, 9 December 2013

9 Dec 2013

The patterns seem to show that there is further upside for the SPX and market. The question is if we will make new highs marginally or shoot up. We are currently resting on one of the Green dotted angle and another one is just overhead.

Main-Trend: DOWN

Short-Term: UP

Main-Trend: DOWN

Short-Term: UP

Friday, 6 December 2013

6 Dec 2013

Todays Jobs number pushed prices higher in the US markets. Prices for the SPX has now come back up above the previous up trending angle. We should watch for an intra-day pull back next week due to the fact that we are in a downward trending momentum. If our short-term trend turns up next week, that is when we could go long on the positions. A bearish note could have us count this up trend as an ABC up pattern. So we do need that short term trend to confirm the move up. We could also be setting up for a head and shoulder pattern so the push up today by way of the jobs number could just be a "Bull Trap".

Main-Trend: DOWN (Overbought)

Short-Term: DOWN

The chart above shows what would happen if our H&S pattern were to unfold and what EW pattern might occur. Now this is just a possible scenario since we are trending down still, so watch for it.We would however see a bullish move if we drop down in 3 wave pattern next week as the intra-day signals might suggest being on a downtrend. So what to do here? with all these options? I always go by my indicator first, and it never lies. It can however be late, but never lies. That being said, trend is down so surprise expectations is to the downside.

Main-Trend: DOWN (Overbought)

Short-Term: DOWN

The chart above shows what would happen if our H&S pattern were to unfold and what EW pattern might occur. Now this is just a possible scenario since we are trending down still, so watch for it.We would however see a bullish move if we drop down in 3 wave pattern next week as the intra-day signals might suggest being on a downtrend. So what to do here? with all these options? I always go by my indicator first, and it never lies. It can however be late, but never lies. That being said, trend is down so surprise expectations is to the downside.

Thursday, 5 December 2013

5 Dec 2013

SPX still holding the 60min 200ma. A break below this could spell disaster. Todays price action looks corrective and "should" move higher, but our indicators are still pointing to the down position. This is where we need to be careful as the jobs numbers come out tomorrow. Not that it matters but most likely will be the "It" factor for those who fundamentally believe that prices follow news.

Main-Trend: DOWN (Unconfirmed)

Short-Term: DOWN

Main-Trend: DOWN (Unconfirmed)

Short-Term: DOWN

Wednesday, 4 December 2013

4 Dec 2013

Prices made a quick run down to the 1780 where the 200ma resides in the 60min chart. Our intra-day is now pointing up again with a positive divergence. Below the 60min chart is a possible EW count labelled on the 5min chart. The most bearish would be the green 1-2-3-4-5 count, with the most bullish being the ABC in pink with an alternate B wave that could still be in the process. It can go either way so be attentive at this point.

Main-Trend: DOWN (Unconfirmed)

Short-Term: DOWN

Note: Todays daily candle bar produced a reversal candle, and so did the 60min bar, so watch for a biased move tomorrow.

Main-Trend: DOWN (Unconfirmed)

Short-Term: DOWN

Note: Todays daily candle bar produced a reversal candle, and so did the 60min bar, so watch for a biased move tomorrow.

Tuesday, 3 December 2013

3 Dec 2013

Todays Intra-day analysis of 1790 was surpassed by only 2.15 pts. The angle drawn this morning proved to be a good support. I have added another angle that I did not see till after, this crosses the other angle line and a bounce in price appear to have confirmed it. On a 5min scale we can see an EW 3 wave pattern moving up from the lows, so we still do not know if this bounce is corrective or impulsive in manner. All I can say is that the 60min stochastics is at the oversold level, and should elevate out of the oversold range to have a chance to run up. Some can say we have made a 5 wave move down, but counting in a minute scale is not reliable. For now, our indicators say that we are on a short-term downtrend.

Main-Trend: Down(Unconfirmed)

Short-Term: Down

Main-Trend: Down(Unconfirmed)

Short-Term: Down

3 Dec INTRA

We might see support here near 1790 SPX with a possible EW 5 wave pattern down. Risk would be to the downside and we should look for a 3 wave rally up if this is the case.

Monday, 2 December 2013

2 Dec 2013

For the most part of the day prices for the SPX have been following our angle line before the late afternoon breakdown. These lines play a big part in prices regardless what fundamentalists say. We have made a low near the 75 ma in the 60min chart and have bounce. The intra-day charts are still pointing down so we must give some allowance for more downside bias. The EW count looks good but nothing is for certain. Therefore we will just wait to see if this downtrend resumes into a larger move. The next level to watch is the 1780 where the 200ma for the 60min chart is currently positioned.

Main-Trend: UP

Short-Term: DOWN

Main-Trend: UP

Short-Term: DOWN

Subscribe to:

Comments (Atom)