Reaction day was a dud. We did close the month with a red candle so that has some significance, since we haven't see that since Oct 2012. The week closed with a reversal candle and we have not manage to close that gap around the 1630 area of the SPX. Now it is not necessary to fill a gap but one must be aware of it as a possibility that prices will revisit that level.

Mid-Term: DOWN

Short-Term: UP

“Those who have knowledge don’t predict. Those who predict don’t have knowledge.”

Lao Tzu, Chinese philosopher, 6th century BC

PAYPAL

Friday 28 June 2013

Thursday 27 June 2013

27 Jun 2013

Prices pushed through the 75ma with ease but got caught up on the 61.8% resistance. We should expect the resistance to be broken by tomorrow in order for us to reach the GAP to fill it. Just above it is a trend line and a 200 60min ma that are in sync and should act as a resistance. The look we are looking for would be a reversal candle tomorrow and a divergence with the 60min Stoch. We could also have an accelerated move down so we would have to stay cautious of the possibility of a fall.

Mid-Term: DOWN

Short-Term: UP

Mid-Term: DOWN

Short-Term: UP

Wednesday 26 June 2013

CONNECTING THE DOTS

The title has nothing to do with connecting dots, but perhaps its how this study has put everything together very smoothly.

Last month as I went through some of the cycle studies I have been doing, something occurred to me to take counts of weekly bars which is one of Gann's favourite time frames. So I counted the trading bars from 2007 high to 2009 low and I got a total of 74 weeks. I then took 3.1415 which is the value for Pi. Don't ask me why, but some cycle analyst probably know why I took this number and I multiplied it with the number of weeks. The value I got was 232.47 weeks. Adding it to the lows of 2009, I got a approximate date of Sept 2 - 6, 2013.

I didn't know what kind of value this analysis brings, so I put it on the side for more consideration later on. Then, a few days ago I stumbled upon a video by Bloomberg which interviewed Tom McClellan, renowned for his McClellan Oscillator and his Technical Knowledge. You can find some of this work HERE. In the video he talks about using the commitment of trader results (COT) mainly the Commercial activity to forecast 1 year in advance the formation or direction the US Index will be heading. Shifting the values of the COT 1 year to reflect the tops and bottom of the market. Although the values of the market cannot be given, we can at least figure out when a topping process and bottoming process comes in. VIDEO HERE. Note.. This video was taken on March 2012, and accurately called the June 4th bottom in 2012 4months in advance of the video. The chart being shown by Bloomberg is in more detail shown below.

As you can see the Phase shift of a previous data 1 year ahead shows how accurately the EURODOLLAR has called the markets top and bottom. So what does this tell us going forward and what does this have to do with my date of Sept 2-6, 2013? Well, if we take the values of the two COT charts below, you can see a bottom coming in on the month of Sept 2012 (actual value). Then rallying to about the range of Nov 2012 (actual value). This if pushed forward should show us a bottom and top near the Sept 2013 and Nov 2013 respectively....

The chart above starts at June 9 2012, but we can assume that the price high (Commercial traders in Maroon) prior if shifted 1yr forward would be within the May 22 high currently in place.

The 2nd chart also shows the highest commitment by commercial traders to the EURODOLLAR short with a massive short position within the Sept to Oct 2012 (actual value) Shifted 1year forward to 2013 Sept- Oct.

If you believe in this technical results then expect a low near Sept 2013. I received a confirmation of this from an email Tom McClelland sent me below.

" That model is forecasting the slide we are in now, having correctly identified the timing of the May top. It says the market should slide even lower to a low due in September."

This is also the same sentiments by JAY as a potential low discussed at PLANETFORECAST BLOG. If you would like to know more please read the comments on the link to understand a bit of what cycles are being talked about.

-JAYS CHART HERE. I believe Jay's Cycle low for this year falls within the August and September 2013. Jay if your reading this correct me if I'm wrong but I have a date of Sept 13, 2013.

This would then tie in with my Pi calculation of Sept 2013 as well. Since COT results and Jay is calling for a low at this date I would assume my results would also point to a low. But we will analyze it more when we get there.

A potential target for a Sept low for me is the 200 WKLY ma. sitting right now at 1285 SPX WKLY CHART. This is just a speculation of course.

Last month as I went through some of the cycle studies I have been doing, something occurred to me to take counts of weekly bars which is one of Gann's favourite time frames. So I counted the trading bars from 2007 high to 2009 low and I got a total of 74 weeks. I then took 3.1415 which is the value for Pi. Don't ask me why, but some cycle analyst probably know why I took this number and I multiplied it with the number of weeks. The value I got was 232.47 weeks. Adding it to the lows of 2009, I got a approximate date of Sept 2 - 6, 2013.

I didn't know what kind of value this analysis brings, so I put it on the side for more consideration later on. Then, a few days ago I stumbled upon a video by Bloomberg which interviewed Tom McClellan, renowned for his McClellan Oscillator and his Technical Knowledge. You can find some of this work HERE. In the video he talks about using the commitment of trader results (COT) mainly the Commercial activity to forecast 1 year in advance the formation or direction the US Index will be heading. Shifting the values of the COT 1 year to reflect the tops and bottom of the market. Although the values of the market cannot be given, we can at least figure out when a topping process and bottoming process comes in. VIDEO HERE. Note.. This video was taken on March 2012, and accurately called the June 4th bottom in 2012 4months in advance of the video. The chart being shown by Bloomberg is in more detail shown below.

As you can see the Phase shift of a previous data 1 year ahead shows how accurately the EURODOLLAR has called the markets top and bottom. So what does this tell us going forward and what does this have to do with my date of Sept 2-6, 2013? Well, if we take the values of the two COT charts below, you can see a bottom coming in on the month of Sept 2012 (actual value). Then rallying to about the range of Nov 2012 (actual value). This if pushed forward should show us a bottom and top near the Sept 2013 and Nov 2013 respectively....

The chart above starts at June 9 2012, but we can assume that the price high (Commercial traders in Maroon) prior if shifted 1yr forward would be within the May 22 high currently in place.

The 2nd chart also shows the highest commitment by commercial traders to the EURODOLLAR short with a massive short position within the Sept to Oct 2012 (actual value) Shifted 1year forward to 2013 Sept- Oct.

If you believe in this technical results then expect a low near Sept 2013. I received a confirmation of this from an email Tom McClelland sent me below.

" That model is forecasting the slide we are in now, having correctly identified the timing of the May top. It says the market should slide even lower to a low due in September."

This is also the same sentiments by JAY as a potential low discussed at PLANETFORECAST BLOG. If you would like to know more please read the comments on the link to understand a bit of what cycles are being talked about.

-JAYS CHART HERE. I believe Jay's Cycle low for this year falls within the August and September 2013. Jay if your reading this correct me if I'm wrong but I have a date of Sept 13, 2013.

This would then tie in with my Pi calculation of Sept 2013 as well. Since COT results and Jay is calling for a low at this date I would assume my results would also point to a low. But we will analyze it more when we get there.

A potential target for a Sept low for me is the 200 WKLY ma. sitting right now at 1285 SPX WKLY CHART. This is just a speculation of course.

26 Jun 2013

Prices have hit our target or close to it. We could see some more upside. Today the ES Stayed overbought for pretty much the entire day even before market opened. This is the reason why "Overbought" doesn't mean sell. Our 60min SPX entered the overbought area as well. I guess it was playing catch up to the ES all day. One thing to note here is that the ES managed to hit its 1hr 200ma line and have closed under it, while the SPX 1hr chart shows that the prices have not touched our recommended 75ma average, also the 50% Fib retracement, and trendline that hovers above it. Our reactionary date is on the 28th but still within the requirements even if it falls a day before or after. Im not assuming that the markets will go down from here, but we have to keep in mind what has more potential of reacting. A price making a high into a reactionary date continuing higher or turning down. Watch the Stoch. for this clue. We can potentially move past the 75ma target to try to fill the gap made on the 20th.

Mid-Term: DOWN

Short-Term: UP (typo - had it at DOWN)

Note: I have been doing some work on a potential forecast for a bottom. Please check back for some update to this.

Mid-Term: DOWN

Short-Term: UP (typo - had it at DOWN)

Note: I have been doing some work on a potential forecast for a bottom. Please check back for some update to this.

Tuesday 25 June 2013

25 Jun 2013

It is fitting for a pull back to the 1590 SPX range revisiting the 2007 Highs. The patterns look corrective. With the 60min 75ma hovering above the 1600 and a potential reactionary date coming in on June 28th. I would guess just for speculation sake that the move now till Friday will be sideways to moderately up where it could force a continued trend down by end of the week. We shall see as the dates approaches.

Mid-Term: DOWN

Short-Term: UP

(No Trade / Stay on the side / Exit shorts) short-term...

Mid-Term: DOWN

Short-Term: UP

(No Trade / Stay on the side / Exit shorts) short-term...

Monday 24 June 2013

24 Jun 2013

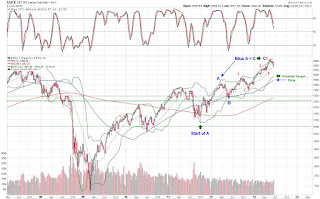

A continued trend lower today broke the 1570 SPX points that we were pegging for an A=C target. Although we don't know for sure if this is an ABC pattern until more patterns have formed. What we do know is that we have hit a 1x2 trend line before bouncing and hitting on a 20ma 60min chart resistance. A gap fill, although not necessary could help markets push up to 1630 SPX.

Mid-Term: DOWN

Short-Term: DOWN

Mid-Term: DOWN

Short-Term: DOWN

NO TIME FOR SUPPORT AND RESISTANCE

I often here or read chart analysis that point out supports and resistance only to be broken or in most cases only last for a few short while. I would like to let the readers of my blog in on something that would be considered common sense, and that is "Always know what time frame your looking at". By that I mean looking at your indicators to see which one is reversing and which one is still on trend.

A 15min chart with a reversal indicator is only good for 15min to an hour or so, yet it maybe that its daily is still on a down trend. Therefore, don't take someone's comment of a support or resistance as a definite bottom or top. Try to figure out what type of time frame they are analyzing. See if the bounce or resistance falls inline with your trends.

A 15min chart with a reversal indicator is only good for 15min to an hour or so, yet it maybe that its daily is still on a down trend. Therefore, don't take someone's comment of a support or resistance as a definite bottom or top. Try to figure out what type of time frame they are analyzing. See if the bounce or resistance falls inline with your trends.

Sunday 23 June 2013

Friday 21 June 2013

21 Jun 2013

The rally today after a brutal morning was said to be from Hilsenrath talking. Meanwhile our intra-day indicators at this low was oversold and turning positive even before he spoke. It was also the stopping point for the weekly 20ma. Going back to yesterdays analysis I mentioned that the 75ma had to be broken for bears to run. It was, and today prices managed to reach up to the 75ma only to be turned back down. This week has closed again to another bearish tone and still far away from being oversold. We should see this coming week as it will be an important week and end of month. At the moment 1631 is the monthly open that if crossed would still keep the bullish candle alive which has been on trend for 7 months. This bearish monthly candle so far looks good to print the month in bear mode, and possibly push the monthly stoch. out of the overbought range for the first time since February 2012.

Mid-Term: DOWN

Short-Term:DOWN

Seems there was a break of the lower trend line critical to the Canadian dollar. Line draw might not be as accurate but one thing for sure is the tail has pierced through. A confirmation would accelerate the Looney downward. Target breakdown was 1.5 months early as you can see below.

Mid-Term: DOWN

Short-Term:DOWN

Seems there was a break of the lower trend line critical to the Canadian dollar. Line draw might not be as accurate but one thing for sure is the tail has pierced through. A confirmation would accelerate the Looney downward. Target breakdown was 1.5 months early as you can see below.

Thursday 20 June 2013

20 Jun 2013

Yesterdays warning of the Gold, Silver, Copper market was scary accurate even though they did not move much in yesterdays FED SPEAK. Today the metals that mattered got attacked.

With the June 6th low being broken we can now rule out any 1-2 combination in EW patterns to the upside and with that a wedge count that possibly count as an abcde. Rather the ABC up for a ii or B wave blue is still in play. The market today moved impulsively and an A=C scenario would find prices stop at the 1570 target. But one can count a full 5 wave down from the highs made on June 18 so a rally should pull prices back. Only then will things become interesting due to the fact that it could be a 3rd of 3rd down or a C wave of C down. As I write this post, Zero Hedge posted an article on Circuit Breakers. Looks like markets might be jittery. The gap today might need to be covered on the SPX chart so a rally to the range of 1630 should fix that.

Therefore:

Bulls need to see a 5wave move up and Bears need to see 3 wave move up.

Mid-Term: Down

Short-Term: Down

Indicators are agreeing with each other to the downside so a continued short is recommended.

With the June 6th low being broken we can now rule out any 1-2 combination in EW patterns to the upside and with that a wedge count that possibly count as an abcde. Rather the ABC up for a ii or B wave blue is still in play. The market today moved impulsively and an A=C scenario would find prices stop at the 1570 target. But one can count a full 5 wave down from the highs made on June 18 so a rally should pull prices back. Only then will things become interesting due to the fact that it could be a 3rd of 3rd down or a C wave of C down. As I write this post, Zero Hedge posted an article on Circuit Breakers. Looks like markets might be jittery. The gap today might need to be covered on the SPX chart so a rally to the range of 1630 should fix that.

Therefore:

Bulls need to see a 5wave move up and Bears need to see 3 wave move up.

Mid-Term: Down

Short-Term: Down

Indicators are agreeing with each other to the downside so a continued short is recommended.

Wednesday 19 June 2013

19 Jun 2013

Reaction day did not disappoint. The bears are happy campers today, but it is still too early to celebrate. Although we had a substantial move today it wasn't enough to be considered scary, and it might just be precautionary to take some profits by some and sit and wait to see what happens next before re-entering markets. I think what is important is how the world markets see this FED SPEAK as they open tonight in Asia and Europe in the early morning.

It is hard to tell if we have a bearish engulfing candle on the daily chart. If it is, we could be in for more downside. The patterns that I have been drawing the past few days to week has turned from a potential abc to an abcde rising wedge. This pattern is also bearish for prices. We will be able to know soon enough from the attitude of any downside move. We have another reactionary day on Jun 28th and its considered a strong one. Whether it is a bottom or a top will depend where prices are when we arrive on that date. One thing to note also is that we have once again broken the 60min charts 200ma line shown below. This is the range that traders are going back and forth over and should see some sort of resolution sooner than later.

Mid-Term: DOWN

Short-Term: UP

We remain on the side until both indicators agree with each other.

It is hard to tell if we have a bearish engulfing candle on the daily chart. If it is, we could be in for more downside. The patterns that I have been drawing the past few days to week has turned from a potential abc to an abcde rising wedge. This pattern is also bearish for prices. We will be able to know soon enough from the attitude of any downside move. We have another reactionary day on Jun 28th and its considered a strong one. Whether it is a bottom or a top will depend where prices are when we arrive on that date. One thing to note also is that we have once again broken the 60min charts 200ma line shown below. This is the range that traders are going back and forth over and should see some sort of resolution sooner than later.

Mid-Term: DOWN

Short-Term: UP

We remain on the side until both indicators agree with each other.

TURNED OVER

Copper has turned down

Gold has turned down

Silver has turned down while still oversold

Treasury bonds turning up

Turkeys market pushing lower

China entered oversold range

These have bearish implications....

Gold has turned down

Silver has turned down while still oversold

Treasury bonds turning up

Turkeys market pushing lower

China entered oversold range

These have bearish implications....

Tuesday 18 June 2013

18 Jun 2013

Price Pattern is right on track for a ii wave or B wave blue. Yesterdays low could also be counted as a B wave of and abc blue pattern which converges with all resistance level of 1660. This level should be watched for potential turning point. Of course we would need to confirm that with our indicators.

Mid-Term: DOWN

Short-Term: UP

Our short-term indicator has been pretty good on calling a bottom on the 14th of June just 1 day after the June 13th bottom. This is short-term so remember that it is more inclined to be volatile. It is however counter trending our Mid-term bottom so trades to the upside should me made on a daily basis unless the Mid-term turns in agreement with the daily. Also with prices inching higher to FED speak day, it creates a better chance of a downside move than if we saw a low into FED speak day.

We also have a reactionary date tomorrow June 19th and with BernanQE talking tomorrow, that would be a given.

Mid-Term: DOWN

Short-Term: UP

Our short-term indicator has been pretty good on calling a bottom on the 14th of June just 1 day after the June 13th bottom. This is short-term so remember that it is more inclined to be volatile. It is however counter trending our Mid-term bottom so trades to the upside should me made on a daily basis unless the Mid-term turns in agreement with the daily. Also with prices inching higher to FED speak day, it creates a better chance of a downside move than if we saw a low into FED speak day.

We also have a reactionary date tomorrow June 19th and with BernanQE talking tomorrow, that would be a given.

Monday 17 June 2013

17 Jun 2013

The daily chart shows that the price movement in the SPX has had a hard time breaking above the 20ma. prices have tried 3 times and the last 10 days and is still below. This is bearish until it breaks above and stays above the 20 daily ma. As for the EW patterns, the most bearish scenario is also the most bullish scenario. Only the triangular pattern can cause a short term bear trend that if it comes to fruition would push prices higher after its wave C bottom indicated by the red trending arrow. The bullish case has this moving up from the lows on June 6 as a 1-2, 1-2, and todays move as another 1-2. For now though our trend...

Mid-Term: DOWN

Short-Term: UP

Mid-Term: DOWN

Short-Term: UP

Sunday 16 June 2013

WEEKEND WRAP

It is hard to believe but we have closed down for almost a month without breaking new highs. As Europe and the Middle East tension rise some markets still remains calm, namely the U.S. markets. Everything else this week had it worse. Metals seems to be holding their own and resisting the urge to go lower. Weekends used to be an agonizing two days, but now it seems its a good way to analyze the market at pause. So what have we found so far?

Believe it or not, the financials has hardly broken a sweat and its far from being oversold. On a weekly basis the BKX has had its first week below the upper Bollinger band which has stayed above for 4 to 5 weeks previous. With a long weekly red candle bar, I would call this pretty bearish. Many are expecting the markets to rally due to oversold reading and as we know oversold doesn't mean reversal. In fact, where markets made oversold territory, most financials have not. Is it just slow in catching up or is there strength to this sector? One look at the weekly bars of BKX or BPFINA shows that there is either a bearish weekly engulfing candle or a streak of monthly red bars. Just like the Bears looking for a reversal as markets made their way up from 2012. The same can be said going down, and we should soon see enough whether the trend has changed if the rallies are small to non-existent. Characters of strength favouring the downside.

A few markets to note:

- Greece market has formed a weekly reversal candle, but the trend still remains down.

- CCI still remains weak and in oversold territory

- Canadian Dollar has rallied hard but has hit a road block in its 20 and 200 wkly ma. It must break these barriers for a bullish trend to resume or confirmed.

- FTSE remains bearish and has not hit oversold even with a 4 week decline.

- Gasoline has been trending up which could only be bad for markets.

- Gold which everyone is watching like a hawk has been trending sideways and putting in reversal candle patterns. What goes sideways usually continues in trend, in this case down. A 1300 to 1250 is not out of the question.

- Heating oil is also in sync with Gasoline...

- Hang Seng has broken key levels on the weekly chart. 75, 200, and Lower BB all taken out and have closed below for the week.

- KOSPI has retained some support within its lower BB like just above the 200ma.

- Lumber had its worst week yet and closed below its BB. Next stop 200ma at $270.

- NATGAS not only closed down for 3 consecutive weeks, but it closed under its 200 and 20 wkly ma.

- Nikkei couldn't hold its 20wk ma and its 200 and lower BB sits in the 10500 to 10000 range.

- Philippine Stocks have gotten hammered and this is not for the lack of warning I have made here. currently resting on its Lower Wkly BB.

- Russell managed to peak its head out of overbought and it is a wonder to be had knowing what happening everywhere else.

- Silver is still oversold and should continue lower, my target for silver has been always in the 18 dollar range and will reassess when it has been reached, but in the case that it doesn't I am still un-doubtfully happy with its move.

- Soybeans is the next one on the block. The pattern and momentum of this commodity is waning and is running out of breath.

- SSEC China has had its worst 2weeks yet. Not only did it not manage to hold on to its 20wk ma, but its also sitting on its lower BB line that is trending down. Currently not even oversold.. Sucks to be China. On the bright side though, the stochastics has diverged with price. Should this be enough to turn its market around we should see a fast spike, but we will see when we get there.

- TSX Toronto market has since made a huge downtrend since we called notice to the reversal candle top a month ago. Currently its head and shoulder formation looks like its in great shape. It has closed below its 200 and 75 wkly ma this week.

- USD.. Anyone who says markets rise when USD falls will have been shocked for a month now. Both US. Markets and USD have been in agreement to trend lower.

- UTIL is probably the bright spot in all this gloom. It has managed to hold its 75wkly ma. This needs to hold or else a weaker outlook is at hand. 75wkly ma is currently at 474.31.

- WTIC seems to be in good position to break out to the upside as well. Bearish implications can be said for an upside move or downside move. A move higher might be a stress to the US. Economy while a wkly chart seems to be forming a triangular wedge, and if the pattern is correct a continuation lower will be likely.

- XAD Australian Dollar has been introuble for 9 weeks already failing to hold its 20 and 75wkly ma and has broken its 200wkly ma 5 weeks ago. auzzie auzzie auzzie.....

- XJY Japanese Yen has been on a tear. I saw a few weeks back an article regarding Mark Cuban borrowing the YEN to pay for Dollar Debt. Smart but one look at the chart then told you that a ending diagonal wedge is at hand and a reversal was to come.

- EEM Emerging markets is in a lot of hurt falling for the first time below its 75, 200wkly ma, and lower BB. So anyone bullish for the hyped up markets should look twice.

- Copper has turned bearish again and one must watch this commodity as a bellweather for markets around the world.

If there is one thing to take away from this is that while most markets around the world sitting on a thin branch just aching to break, the U.S. markets seems to be holding up. Maybe everyone in the world has been running to the U.S. for investment safety? Well, we know full well it is not immune and its just a matter of time. Playing catch up is a Bitch!!! Are we looking through rose coloured glasses or are they bloody glasses? Here is a hint and I always save the best for last.

The NYSE percent of stocks above its 200MA signal line is sitting on 67.71. Also below the 75ma and just above its 200ma. With its Stoch. at a new weekly entrance of oversold territory it is definitely between a thin line and hard place.

EOMessage....

Believe it or not, the financials has hardly broken a sweat and its far from being oversold. On a weekly basis the BKX has had its first week below the upper Bollinger band which has stayed above for 4 to 5 weeks previous. With a long weekly red candle bar, I would call this pretty bearish. Many are expecting the markets to rally due to oversold reading and as we know oversold doesn't mean reversal. In fact, where markets made oversold territory, most financials have not. Is it just slow in catching up or is there strength to this sector? One look at the weekly bars of BKX or BPFINA shows that there is either a bearish weekly engulfing candle or a streak of monthly red bars. Just like the Bears looking for a reversal as markets made their way up from 2012. The same can be said going down, and we should soon see enough whether the trend has changed if the rallies are small to non-existent. Characters of strength favouring the downside.

A few markets to note:

- Greece market has formed a weekly reversal candle, but the trend still remains down.

- CCI still remains weak and in oversold territory

- Canadian Dollar has rallied hard but has hit a road block in its 20 and 200 wkly ma. It must break these barriers for a bullish trend to resume or confirmed.

- FTSE remains bearish and has not hit oversold even with a 4 week decline.

- Gasoline has been trending up which could only be bad for markets.

- Gold which everyone is watching like a hawk has been trending sideways and putting in reversal candle patterns. What goes sideways usually continues in trend, in this case down. A 1300 to 1250 is not out of the question.

- Heating oil is also in sync with Gasoline...

- Hang Seng has broken key levels on the weekly chart. 75, 200, and Lower BB all taken out and have closed below for the week.

- KOSPI has retained some support within its lower BB like just above the 200ma.

- Lumber had its worst week yet and closed below its BB. Next stop 200ma at $270.

- NATGAS not only closed down for 3 consecutive weeks, but it closed under its 200 and 20 wkly ma.

- Nikkei couldn't hold its 20wk ma and its 200 and lower BB sits in the 10500 to 10000 range.

- Philippine Stocks have gotten hammered and this is not for the lack of warning I have made here. currently resting on its Lower Wkly BB.

- Russell managed to peak its head out of overbought and it is a wonder to be had knowing what happening everywhere else.

- Silver is still oversold and should continue lower, my target for silver has been always in the 18 dollar range and will reassess when it has been reached, but in the case that it doesn't I am still un-doubtfully happy with its move.

- Soybeans is the next one on the block. The pattern and momentum of this commodity is waning and is running out of breath.

- SSEC China has had its worst 2weeks yet. Not only did it not manage to hold on to its 20wk ma, but its also sitting on its lower BB line that is trending down. Currently not even oversold.. Sucks to be China. On the bright side though, the stochastics has diverged with price. Should this be enough to turn its market around we should see a fast spike, but we will see when we get there.

- TSX Toronto market has since made a huge downtrend since we called notice to the reversal candle top a month ago. Currently its head and shoulder formation looks like its in great shape. It has closed below its 200 and 75 wkly ma this week.

- USD.. Anyone who says markets rise when USD falls will have been shocked for a month now. Both US. Markets and USD have been in agreement to trend lower.

- UTIL is probably the bright spot in all this gloom. It has managed to hold its 75wkly ma. This needs to hold or else a weaker outlook is at hand. 75wkly ma is currently at 474.31.

- WTIC seems to be in good position to break out to the upside as well. Bearish implications can be said for an upside move or downside move. A move higher might be a stress to the US. Economy while a wkly chart seems to be forming a triangular wedge, and if the pattern is correct a continuation lower will be likely.

- XAD Australian Dollar has been introuble for 9 weeks already failing to hold its 20 and 75wkly ma and has broken its 200wkly ma 5 weeks ago. auzzie auzzie auzzie.....

- XJY Japanese Yen has been on a tear. I saw a few weeks back an article regarding Mark Cuban borrowing the YEN to pay for Dollar Debt. Smart but one look at the chart then told you that a ending diagonal wedge is at hand and a reversal was to come.

- EEM Emerging markets is in a lot of hurt falling for the first time below its 75, 200wkly ma, and lower BB. So anyone bullish for the hyped up markets should look twice.

- Copper has turned bearish again and one must watch this commodity as a bellweather for markets around the world.

If there is one thing to take away from this is that while most markets around the world sitting on a thin branch just aching to break, the U.S. markets seems to be holding up. Maybe everyone in the world has been running to the U.S. for investment safety? Well, we know full well it is not immune and its just a matter of time. Playing catch up is a Bitch!!! Are we looking through rose coloured glasses or are they bloody glasses? Here is a hint and I always save the best for last.

The NYSE percent of stocks above its 200MA signal line is sitting on 67.71. Also below the 75ma and just above its 200ma. With its Stoch. at a new weekly entrance of oversold territory it is definitely between a thin line and hard place.

EOMessage....

Friday 14 June 2013

14 Jun 2013

Two scenarios that could pan out. Yesterdays EW count is still intact for an abc up pattern for a 2nd wave or B wave blue (Bearish), but the upper resistance channel from the top of May 22nd is making it hard to make a move to the upside near 1660 area of SPX.

Another pattern can be seen as an alternate that show a possible triangular formation that puts us at a B wave blue that brings us down to an eventual low near the Mid-April low for C blue. Although both scenarios see us going lower, the latter will see us bounce right after we make the lower price range of 1540-1550 SPX breaking the highs made on May 22nd. Of course we still have the bullish count that was brought up in yesterdays analysis that would bring us to a wave 3 up for whatever the new high count would be (Maybe green C pushed up in Price and Time).

Mid-Term: DOWN

Short-Term: UP

The Short-Term has been very volatile lately and it fits with a triangular pattern with sudden whipsaws. Once we break out of this range (assuming we have a triangular pattern), we should see a few more days to weeks of downward pressure.

Scenario A:

Scenario B:

Another pattern can be seen as an alternate that show a possible triangular formation that puts us at a B wave blue that brings us down to an eventual low near the Mid-April low for C blue. Although both scenarios see us going lower, the latter will see us bounce right after we make the lower price range of 1540-1550 SPX breaking the highs made on May 22nd. Of course we still have the bullish count that was brought up in yesterdays analysis that would bring us to a wave 3 up for whatever the new high count would be (Maybe green C pushed up in Price and Time).

Mid-Term: DOWN

Short-Term: UP

The Short-Term has been very volatile lately and it fits with a triangular pattern with sudden whipsaws. Once we break out of this range (assuming we have a triangular pattern), we should see a few more days to weeks of downward pressure.

Scenario A:

Scenario B:

Thursday 13 June 2013

13 Jun 2013

There are so much data from todays price movement and I will try to summarize it as much as possible. Todays impulsive move is what we expected the c wave to be of a bearish EW count to form a blue ii wave or a blue B wave (if Blue B occurs then a 3 wave pattern down would make a Blue C). A ii wave would allow for an impulsive move down for a iii wave. On a bullish EW count, a continuation move up past 1660 would suggest that higher highs are in store. I would not however say that if we made higher highs that it would be the last pattern/formation. Although it would lead to a weekly divergence between price and Stoch. We should just revisit that thought when and if we get there. The Daily chart has shown a bullish engulfing candle and this should be good news for the bulls.

The dotted trend lines drawn are 1x2 trend lines which are equally important as the 1x1 trend lines that GANN likes to use. These lines acts as possible support and resistance and it has over the course of the move up from late April. Todays end of day price close is not by chance. Why? There are a lot of resistance here for the day.

- 1x2 Gann Down trend resistance

- 200 ma resistance

- 61.8% of red wave a resistance

- Not shown and a few points shy is the 20 ma on the daily chart which sits on 1643.34 day close.

- This area is also within the 38.2% FIB. of the move from Mid-April low to May 22 highs.

So what to expect in the next few days:

-Look for a resistance on 1660 for a bearish move.

-Any move above the 1660 level would be considered bullish

-The impulsive move in both directions would also be important as an indicator.

-The low made on June 6th must be broken to favour the Bears.

With all that said, we should still follow our indicators which are still pointing to the downside.

Mid-Term: DOWN

Short-Term: DOWN

Note: RED wave A and RED wave B should be in colour blue.

The dotted trend lines drawn are 1x2 trend lines which are equally important as the 1x1 trend lines that GANN likes to use. These lines acts as possible support and resistance and it has over the course of the move up from late April. Todays end of day price close is not by chance. Why? There are a lot of resistance here for the day.

- 1x2 Gann Down trend resistance

- 200 ma resistance

- 61.8% of red wave a resistance

- Not shown and a few points shy is the 20 ma on the daily chart which sits on 1643.34 day close.

- This area is also within the 38.2% FIB. of the move from Mid-April low to May 22 highs.

So what to expect in the next few days:

-Look for a resistance on 1660 for a bearish move.

-Any move above the 1660 level would be considered bullish

-The impulsive move in both directions would also be important as an indicator.

-The low made on June 6th must be broken to favour the Bears.

With all that said, we should still follow our indicators which are still pointing to the downside.

Mid-Term: DOWN

Short-Term: DOWN

Note: RED wave A and RED wave B should be in colour blue.

Wednesday 12 June 2013

12 Jun 2013

The SPX managed to have a down day today again, but we have not broken the low from the 6th of June. I suspect that the move down recently is still in corrective mode and judging from the patterns a sideways move is not out of the question for a while. The bearish count on a 5min scale below is what I see happening but again, EW should be taken as possibilities not probability. Always stay with your indicators and trade the setups based on it.

Mid-Term: DOWN

Short-Term: DOWN

Mid-Term: DOWN

Short-Term: DOWN

Tuesday 11 June 2013

11 Jun 2013

Critical point for Bears is the low on Jun 6. This low needs to be taken out for a bearish continuation. The pattern though still looks Corrective down and the risk is for more upside potential. A push up in prices by SPX without breaking the High on May 31st would be a good pattern for EW Bears. Which keeps a possible (1-2, 1-2, 1-2) down.

Mid-Term: DOWN

Short-Term: UP

For Bearish sake I have put a count below of what it could possibly look like going down. This of course would lead to a violent push downward.

NOTE: Longer term trend is still in an upward bias. But we act on our indicator with caution until we get a confirmation.

Mid-Term: DOWN

Short-Term: UP

For Bearish sake I have put a count below of what it could possibly look like going down. This of course would lead to a violent push downward.

NOTE: Longer term trend is still in an upward bias. But we act on our indicator with caution until we get a confirmation.

Monday 10 June 2013

10 Jun 2013

Time fib arrives this week and on a 60min time frame price is reaching close to its 61.8% retracement. The move up today in the SPX looks corrective and its not looking like its done going up. Meanwhile the 60min chart is diverging suggesting a pullback is near. How intense or long will the pull back be? We will just have to keep a close eye on it.

Mid-Term: DOWN

Short-Term: UP

Mid-Term: DOWN

Short-Term: UP

Friday 7 June 2013

7 Jun 2013

Broke above 75ma, and possibly made 5 waves up. ES also made 5 waves up in a diagonal fashion. Short term up and out of oversold condition.

Mid-Term:DOWN

Short-Term: UP

Action: cover short and wait for Short-Term to turn down again.

Mid-Term:DOWN

Short-Term: UP

Action: cover short and wait for Short-Term to turn down again.

MID-AFT WARNING...

ES diverging on 60min and making 3wave pattern up from yesterdays low. Does not have a complete 5 wave up. So a break down could still occur before close so watch out for going long too early. The SPX tells another story trying to finish of a 5 wave pattern.

Thursday 6 June 2013

6 Jun 2013

6/6/ (2+0+1+3=6) = 666.. Just for fun

Prices rallied from lows to a 60min resistance at its 20ma. Most importantly is the 75ma at around 1635. Would need to break above this for bulls to run.

Mid-Term:DOWN

Short-Term:DOWN

Prices rallied from lows to a 60min resistance at its 20ma. Most importantly is the 75ma at around 1635. Would need to break above this for bulls to run.

Mid-Term:DOWN

Short-Term:DOWN

Wednesday 5 June 2013

5 Jun 2013

Yesterdays I recommended that the 50% Fib. retracement be looked at for the next support. today it seems to have made a stop there and a possible divergence could occur in the 60min chart to move prices down for tomorrow. Again on an EW pattern the 62% retracement is a critical juncture which is at the 1593 range. This separates our count from a 4th to a possible penetration lower to complete a 1st wave down on a bearish note. The reason for this is that a 4th wave cannot overlap the 1st wave. The other alternative for a bullish count is if it does penetrate the 62% Fib. we can possibly count it as a 2nd wave of some other degree. For now the 4th wave is still intact.

Mid-Term: DOWN

Short-Term: DOWN

Our daily chart for the SPX has not seen an oversold condition since Nov. of 2012. This is a good sign for bears. Also one thing to note, is that prices have pierced the lower BB line in a daily scale so a rally is not out of the norm.

Mid-Term: DOWN

Short-Term: DOWN

Our daily chart for the SPX has not seen an oversold condition since Nov. of 2012. This is a good sign for bears. Also one thing to note, is that prices have pierced the lower BB line in a daily scale so a rally is not out of the norm.

On a Canadian Stock Exchange note, we are entering a very bearish setup. One that could collapse at any moment. This week the TSX would have to close with a weekly reversal candle to keep the bullish trend from April alive.

Tuesday 4 June 2013

4 Jun 2013

The 60min. SPX chart with its 20ma proved to be the strong resistance today. Price failed to push through it. Tuesdays win streak was also broken today and we have now closed under the 200ma in the 60min chart. This will have to be watched carefully to see if there is any significance to the 200ma.

There is importance for an acceleration down if the bears are looking for a signal that this move is in their favour. We would need for the up trending blue dotted line from the late April bottom to be broken. This is also the reason why we are trading in such a small trading range. Some EW practitioner in the bearish camps are counting a wave structure as (1-2 1-2 1-2) down, and we can only count so many of those until it becomes ridiculously wrong.

I believe EW is best counted with the main trending sentiment. Meaning that since 2009 the trend has been clearly up and through that time until now the bears have been counting an end to the pattern and has brought major disappointment and embarrassment to themselves. I believe we have to count it based on a bullish trend until it becomes apparent that it has turned. So like you see at the chart below, the only count is the ABC for 4th until it is otherwise proven to me that the trend is really bearish.

Our indicators still working perfectly since its call for a turn down on 22nd unconfirmed (24th of may confirmed). Following this has a much better chance of success as compared to the rest of the other analysis. Simple is sometimes better...

Mid-Term: DOWN

Short-Term: DOWN

Note: The best trades is when both are in sync with each other, just like the above sentiments.

There is importance for an acceleration down if the bears are looking for a signal that this move is in their favour. We would need for the up trending blue dotted line from the late April bottom to be broken. This is also the reason why we are trading in such a small trading range. Some EW practitioner in the bearish camps are counting a wave structure as (1-2 1-2 1-2) down, and we can only count so many of those until it becomes ridiculously wrong.

I believe EW is best counted with the main trending sentiment. Meaning that since 2009 the trend has been clearly up and through that time until now the bears have been counting an end to the pattern and has brought major disappointment and embarrassment to themselves. I believe we have to count it based on a bullish trend until it becomes apparent that it has turned. So like you see at the chart below, the only count is the ABC for 4th until it is otherwise proven to me that the trend is really bearish.

Our indicators still working perfectly since its call for a turn down on 22nd unconfirmed (24th of may confirmed). Following this has a much better chance of success as compared to the rest of the other analysis. Simple is sometimes better...

Mid-Term: DOWN

Short-Term: DOWN

Note: The best trades is when both are in sync with each other, just like the above sentiments.

Monday 3 June 2013

3 June 2013

SPX reached our first support which exceeded a few pts. This support today was also the 200ma for the 60min. chart. We mentioned last week that there are 3 supports to watch for and we should no look for a test of the lower triangular support line that was broken last week. If this test proves to be a resistance then we would owe it to the 20ma (Bold Blue Dotted line). An EW A=C pattern rest exactly at our 50% level around 1610 range. But in the mean time, our trend still looks bearish.

Mid-Term: DOWN

Short-Term: DOWN

A breach of the green dotted line and last support shown on the chart above would suggest that the trend change is not a correction (abc), but a full trend change.

Mid-Term: DOWN

Short-Term: DOWN

Subscribe to:

Posts (Atom)