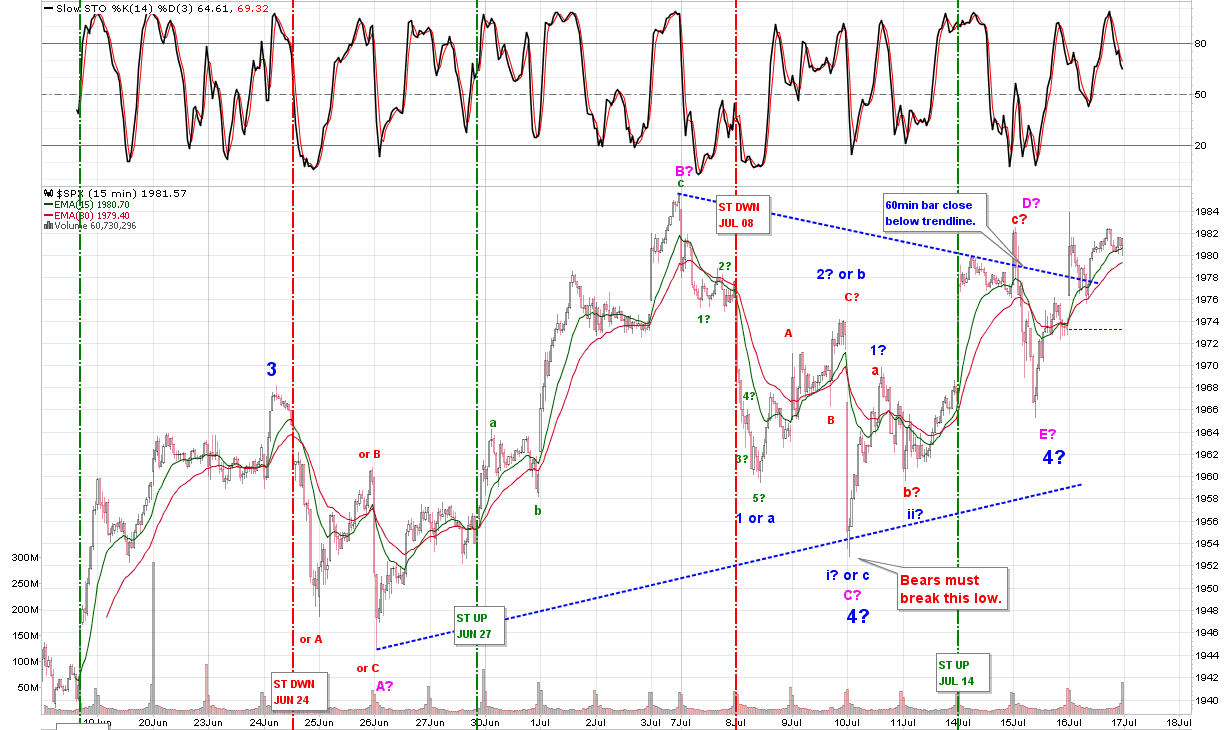

As I mentioned on yesterdays post, the price closing below the 200ma of the 60min chart is critical. Now the 75ma and the 200ma is on a verge of crossing which is bearish. If you followed our ST's down ward trending warning you would have profited handsomely, and if you had followed our PA sentiment. You would have profited on any volatile Stocks, Options or ETF's. It looks to me like the downward pattern has not ended yet and is missing an extra set of waves. Let us not forget that EW is not perfect so lets watch the ST for a Short-Term trend change if there is one. For now it is bearishly down.

MT: DOWN

ST: DOWN

PA: DOWN

“Those who have knowledge don’t predict. Those who predict don’t have knowledge.”

Lao Tzu, Chinese philosopher, 6th century BC

PAYPAL

Thursday 31 July 2014

Wednesday 30 July 2014

The Trigger Points For World War III Are In Place

By: ROGER COHEN, THE ATLANTIC

Pessimism is a useful prism through which to view the affairs of states. Their ambition to gain, retain, and project power is never sated. Optimism, toward which Americans are generally inclined, leads to rash predictions of history’s ending in global consensus and the banishment of war. Such rosy views accompanied the end of the Cold War. They were also much in evidence a century ago, on the eve of World War I.

Then, as now, Europe had lived through a long period of relative peace, after the end of the Napoleonic Wars. Then, too, rapid progress in science, technology, and communications had given humanity a sense of shared interests that precluded war, despite the ominous naval competition between Britain and Germany. Then, too, wealthy individuals devoted their fortunes to conciliation and greater human understanding. Rival powers fumed over provocative annexations, like Austria-Hungary’s of Bosnia-Herzegovina in 1908, but world leaders scarcely believed a global conflagration was possible, let alone that one would begin just six years later. The very monarchs who would consign tens of millions to a murderous morass from 1914 to 1918 and bury four empires believed they were clever enough to finesse the worst.

The unimaginable can occur. That is a notion at once banal and perennially useful to recall. Indeed, it has just happened in Crimea, where a major power has forcefully changed a European border for the first time since 1945. Russia’s act of annexation and its evident designs on eastern Ukraine constitute a reminder that NATO was created to protect Europe after its pair of 20th-century self-immolations. NATO’s core precept, as the Poles and other former vassals of the Soviet empire like to remind blithe western Europeans, is Article 5, by which the Allies agreed that “an armed attack against one or more of them in Europe or North America shall be considered an attack against them all,” triggering a joint military response. This has proved a powerful deterrent against potential adversaries. Vladimir Putin, the Russian president, has been most aggressive in the no-man’s-lands of Georgia and Ukraine, nations suspended between East and West, neither one a member of NATO. Had Ukraine been a member of NATO, the annexation of Crimea would have come only at the (presumably unacceptable) price of war. Article 5, until demonstrated otherwise, is an ironclad commitment.

When a 19-year-old Bosnian Serb nationalist, Gavrilo Princip, assassinated the heir to the Austro-Hungarian throne in Sarajevo, on June 28, 1914, he acted to secure Serbia’s liberty from imperial dominion. He could not have known that within weeks, Austria-Hungary would declare war on Serbia, goading Russia (humiliated in war a decade earlier by Japan) to mobilize in defense of its Slavic ally, which caused the kaiser’s ascendant Germany to launch a preemptive attack on Russia’s ally France, in turn prompting Britain to declare war on Germany.

Events cascade. It is already clear that the nationalist fervor unleashed by Putin after a quarter century of Russia’s perceived post–Cold War decline is far from exhausted. Russians are sure that the dignity of their nation has been trampled by an American and European strategic advance to their border dressed up in talk of democracy, the rule of law, and human rights. Whether this is true is irrelevant; they believe it. National humiliation, real or not, is a tremendous catalyst for war. That was the case in Germany after the Treaty of Versailles imposed reparations and territorial concessions; so, too, in Serbia more than 70 years later, after the breakup of Yugoslavia, a country Serbia had always viewed as an extension of itself. Russia, convinced of its lost greatness, is gripped by a Weimar neurosis resembling Germany’s post–World War I longing for its past stature and power. The Moscow-backed separatists taking over government buildings in eastern Ukraine and proclaiming an independent “Donetsk People’s Republic” demonstrate the virulence of Russian irredentism. Nobody can know where it will stop. Appetite, as the French say, grows with eating.

Let us indulge in dark imaginings, then, in the cause of prudence. Here is one possible scenario: Clashes intensify between Ukrainian government forces and paramilitary formations organized by Russian fifth columnists. The death toll rises. The ongoing NATO dispatch of troops and F‑16s to Poland and the Baltic states, designed as a deterrence, redoubles anger in Russia—“a great and humble nation besieged,” a Russian general might declare. The American president, saying his war-weary country will not seek conflict, imposes sanctions on the entire Russian oil-and-gas sector. European states dependent on Russian energy grumble; a former German chancellor working in natural gas says his country’s interests lie with Moscow. Then, say, an independence movement of the Russian minority gains momentum in Estonia, backed with plausible deniability by Moscow’s agents, and announces support for the Donetsk People’s Republic. A wave of cyberattacks disables Estonian government facilities, and an Estonian big shot calls the Russian leader an “imperialist troglodyte trapped in a zero-sum game.” After an assassination attempt on the Estonian foreign minister at a rally in the capital, calls grow louder for the American president to invoke Article 5. He insists that “drawing red lines in the 21st century is not a useful exercise.”

Let us further imagine that shortly after the president delivers his speech, in a mysterious coincidence, a Chinese ship runs aground on one of the uninhabited Senkaku Islands, administered by Japan, in the East China Sea. China dispatches a small force to what it calls the Diaoyu Islands “as a protective measure.” Japan sends four destroyers to evict the Chinese and reminds the American president that he has said the islands, located near undersea oil reserves, “fall within the scope” of the U.S.-Japan Treaty of Mutual Cooperation and Security. A Republican senator, echoing the bellicose mood in Washington, declares that “Estonia is more than a couple of rocks in the East China Sea” and demands to know whether “the United States has torn up the treaty alliances in Europe and Asia that have been the foundation of global security since 1945.” The president gives China an ultimatum to leave the Japanese islands or face a military response. He also tells Russia that another act of secessionist violence in Estonia will trigger NATO force against Russian troops massed on the Estonian border. Both warnings are ignored. Chinese and Russian leaders accuse the United States of “prolonging Cold War hostilities and alliances in pursuit of global domination.” World War III begins.

It could not happen; of course it couldn’t. Peace, if not outright pacifism, is now bred in the bones of Europeans, who contemplate war with revulsion. Europe is politically and economically integrated. America, after two wars without victory, is in a period of retrenchment that may last a generation. Wars no longer happen between big land armies; they are the stuff of pinpoint strikes by unpiloted drones against jihadist extremists. Putin’s Russia is opportunistic—it will change the balance of power in Ukraine or Georgia if it considers the price acceptable—but it is not reckless in countries under NATO protection. China, with its watchword of “Harmony,” is focused on its own rising success and understands the usefulness of the United States as an offsetting Pacific power able to reassure anxious neighbors like Japan and Vietnam. For the time being, Beijing will not seek to impose its own version of the Monroe Doctrine. It will hold nationalism in check even as the Asian naval arms race accelerates. Unlike in 1914 or 1939, the presence of large American garrisons in Europe and Asia sustains a tenacious Pax Americana. The United Nations, for all its cumbersome failings, serves as the guarantor of last resort against another descent into horror. The specter of nuclear holocaust is the ultimate deterrent for a hyperconnected world. Citizens everywhere now have the tools to raise a cacophony in real time against the sort of folly that, in World War I, produced the deaths of so many unidentifiable young men “known unto God,” in Kipling’s immortal phrasing.

Convincing? It would certainly be nice to believe that, as President Clinton suggested in 1997, great-power territorial politics are a thing of the past. A new era had dawned, he said, in which “enlightened self-interest, as well as shared values, will compel countries to define their greatness in more-constructive ways.” In fact, the realization that the Russian bear can bite as well as growl is timely. It is a reminder that a multipolar world in a time of transition, when popular resentments are rising over joblessness and inequality, is a dangerous place indeed.

The international system does not look particularly stable. The Cold War’s bipolar confrontation, despite its crises, was predictable. Today’s world is not. It features a United States whose power is dominant but no longer determinant; a one-party China that is a rising hegemon; an authoritarian Russia giddy on nationalism and the idea of a restored imperium; and a weak, navel-gazing, blasé Europe whose pursuit of an ever closer union is on hold and perhaps on the brink of reversal.

Pacifist tendencies in western Europe coexist with views of power held in Moscow and Beijing that Bismarck or Clausewitz would recognize instantly. After the genocides in Rwanda and Bosnia, the UN General Assembly ratified the concept that governments have a “responsibility to protect” their citizens from atrocities. But in the face of Syria’s bloody dismemberment and Ukraine’s cynical dismantlement, idealism of that kind looks fluffy or simply irrelevant. The Baltic countries are front-line states once again. The fleeting post–Cold War dream of a zone of unity and peace stretching from Lisbon to Vladivostok has died. As John Mearsheimer observes in his seminal The Tragedy of Great Power Politics, “Unbalanced multipolar systems feature the most dangerous distribution of power, mainly because potential hegemons are likely to get into wars with all of the other great powers in the system.”

In this context, nothing is more dangerous than American weakness. It is understandable that the United States is looking inward after more than a decade of post-9/11 war. But it is also worrying, because the credibility of American power remains the anchor of global security. The nation’s mood is not merely a reflection of economic hardship or the costs of war; it is also determined by the president’s decisions and rhetoric. There was no American majority for involvement in World War I or World War II—until the president set out to forge one (helped decisively in Franklin D. Roosevelt’s case by Pearl Harbor). As Jonathan Eyal of Britain’s Royal United Services Institute says, “If a president stands up and says something, he can shift the debate.”

President Obama has made clear he does not believe in military force. His words spell that out; so does his body language. He asks, after Iraq and Afghanistan, what force accomplishes. These are fair questions; the bar must be very high for unleashing military power. But when an American president marches allies up the hill to defend his “red line”—as Obama did regarding Syria’s use of chemical weapons—and then marches them back down again, he does something damaging that the world does not forget. And when Obama, in response to a recent question about whether declaring that the United States would protect the Senkaku Islands risked drawing another “red line,” gives an evasive answer, he does something so dangerous that his words are worth repeating:

But has it? Consider this article in my father’s 1938 high-school yearbook:

Pessimism is a useful prism through which to view the affairs of states. Their ambition to gain, retain, and project power is never sated. Optimism, toward which Americans are generally inclined, leads to rash predictions of history’s ending in global consensus and the banishment of war. Such rosy views accompanied the end of the Cold War. They were also much in evidence a century ago, on the eve of World War I.

Then, as now, Europe had lived through a long period of relative peace, after the end of the Napoleonic Wars. Then, too, rapid progress in science, technology, and communications had given humanity a sense of shared interests that precluded war, despite the ominous naval competition between Britain and Germany. Then, too, wealthy individuals devoted their fortunes to conciliation and greater human understanding. Rival powers fumed over provocative annexations, like Austria-Hungary’s of Bosnia-Herzegovina in 1908, but world leaders scarcely believed a global conflagration was possible, let alone that one would begin just six years later. The very monarchs who would consign tens of millions to a murderous morass from 1914 to 1918 and bury four empires believed they were clever enough to finesse the worst.

The unimaginable can occur. That is a notion at once banal and perennially useful to recall. Indeed, it has just happened in Crimea, where a major power has forcefully changed a European border for the first time since 1945. Russia’s act of annexation and its evident designs on eastern Ukraine constitute a reminder that NATO was created to protect Europe after its pair of 20th-century self-immolations. NATO’s core precept, as the Poles and other former vassals of the Soviet empire like to remind blithe western Europeans, is Article 5, by which the Allies agreed that “an armed attack against one or more of them in Europe or North America shall be considered an attack against them all,” triggering a joint military response. This has proved a powerful deterrent against potential adversaries. Vladimir Putin, the Russian president, has been most aggressive in the no-man’s-lands of Georgia and Ukraine, nations suspended between East and West, neither one a member of NATO. Had Ukraine been a member of NATO, the annexation of Crimea would have come only at the (presumably unacceptable) price of war. Article 5, until demonstrated otherwise, is an ironclad commitment.

When a 19-year-old Bosnian Serb nationalist, Gavrilo Princip, assassinated the heir to the Austro-Hungarian throne in Sarajevo, on June 28, 1914, he acted to secure Serbia’s liberty from imperial dominion. He could not have known that within weeks, Austria-Hungary would declare war on Serbia, goading Russia (humiliated in war a decade earlier by Japan) to mobilize in defense of its Slavic ally, which caused the kaiser’s ascendant Germany to launch a preemptive attack on Russia’s ally France, in turn prompting Britain to declare war on Germany.

Events cascade. It is already clear that the nationalist fervor unleashed by Putin after a quarter century of Russia’s perceived post–Cold War decline is far from exhausted. Russians are sure that the dignity of their nation has been trampled by an American and European strategic advance to their border dressed up in talk of democracy, the rule of law, and human rights. Whether this is true is irrelevant; they believe it. National humiliation, real or not, is a tremendous catalyst for war. That was the case in Germany after the Treaty of Versailles imposed reparations and territorial concessions; so, too, in Serbia more than 70 years later, after the breakup of Yugoslavia, a country Serbia had always viewed as an extension of itself. Russia, convinced of its lost greatness, is gripped by a Weimar neurosis resembling Germany’s post–World War I longing for its past stature and power. The Moscow-backed separatists taking over government buildings in eastern Ukraine and proclaiming an independent “Donetsk People’s Republic” demonstrate the virulence of Russian irredentism. Nobody can know where it will stop. Appetite, as the French say, grows with eating.

Let us indulge in dark imaginings, then, in the cause of prudence. Here is one possible scenario: Clashes intensify between Ukrainian government forces and paramilitary formations organized by Russian fifth columnists. The death toll rises. The ongoing NATO dispatch of troops and F‑16s to Poland and the Baltic states, designed as a deterrence, redoubles anger in Russia—“a great and humble nation besieged,” a Russian general might declare. The American president, saying his war-weary country will not seek conflict, imposes sanctions on the entire Russian oil-and-gas sector. European states dependent on Russian energy grumble; a former German chancellor working in natural gas says his country’s interests lie with Moscow. Then, say, an independence movement of the Russian minority gains momentum in Estonia, backed with plausible deniability by Moscow’s agents, and announces support for the Donetsk People’s Republic. A wave of cyberattacks disables Estonian government facilities, and an Estonian big shot calls the Russian leader an “imperialist troglodyte trapped in a zero-sum game.” After an assassination attempt on the Estonian foreign minister at a rally in the capital, calls grow louder for the American president to invoke Article 5. He insists that “drawing red lines in the 21st century is not a useful exercise.”

Let us further imagine that shortly after the president delivers his speech, in a mysterious coincidence, a Chinese ship runs aground on one of the uninhabited Senkaku Islands, administered by Japan, in the East China Sea. China dispatches a small force to what it calls the Diaoyu Islands “as a protective measure.” Japan sends four destroyers to evict the Chinese and reminds the American president that he has said the islands, located near undersea oil reserves, “fall within the scope” of the U.S.-Japan Treaty of Mutual Cooperation and Security. A Republican senator, echoing the bellicose mood in Washington, declares that “Estonia is more than a couple of rocks in the East China Sea” and demands to know whether “the United States has torn up the treaty alliances in Europe and Asia that have been the foundation of global security since 1945.” The president gives China an ultimatum to leave the Japanese islands or face a military response. He also tells Russia that another act of secessionist violence in Estonia will trigger NATO force against Russian troops massed on the Estonian border. Both warnings are ignored. Chinese and Russian leaders accuse the United States of “prolonging Cold War hostilities and alliances in pursuit of global domination.” World War III begins.

It could not happen; of course it couldn’t. Peace, if not outright pacifism, is now bred in the bones of Europeans, who contemplate war with revulsion. Europe is politically and economically integrated. America, after two wars without victory, is in a period of retrenchment that may last a generation. Wars no longer happen between big land armies; they are the stuff of pinpoint strikes by unpiloted drones against jihadist extremists. Putin’s Russia is opportunistic—it will change the balance of power in Ukraine or Georgia if it considers the price acceptable—but it is not reckless in countries under NATO protection. China, with its watchword of “Harmony,” is focused on its own rising success and understands the usefulness of the United States as an offsetting Pacific power able to reassure anxious neighbors like Japan and Vietnam. For the time being, Beijing will not seek to impose its own version of the Monroe Doctrine. It will hold nationalism in check even as the Asian naval arms race accelerates. Unlike in 1914 or 1939, the presence of large American garrisons in Europe and Asia sustains a tenacious Pax Americana. The United Nations, for all its cumbersome failings, serves as the guarantor of last resort against another descent into horror. The specter of nuclear holocaust is the ultimate deterrent for a hyperconnected world. Citizens everywhere now have the tools to raise a cacophony in real time against the sort of folly that, in World War I, produced the deaths of so many unidentifiable young men “known unto God,” in Kipling’s immortal phrasing.

Convincing? It would certainly be nice to believe that, as President Clinton suggested in 1997, great-power territorial politics are a thing of the past. A new era had dawned, he said, in which “enlightened self-interest, as well as shared values, will compel countries to define their greatness in more-constructive ways.” In fact, the realization that the Russian bear can bite as well as growl is timely. It is a reminder that a multipolar world in a time of transition, when popular resentments are rising over joblessness and inequality, is a dangerous place indeed.

The international system does not look particularly stable. The Cold War’s bipolar confrontation, despite its crises, was predictable. Today’s world is not. It features a United States whose power is dominant but no longer determinant; a one-party China that is a rising hegemon; an authoritarian Russia giddy on nationalism and the idea of a restored imperium; and a weak, navel-gazing, blasé Europe whose pursuit of an ever closer union is on hold and perhaps on the brink of reversal.

Pacifist tendencies in western Europe coexist with views of power held in Moscow and Beijing that Bismarck or Clausewitz would recognize instantly. After the genocides in Rwanda and Bosnia, the UN General Assembly ratified the concept that governments have a “responsibility to protect” their citizens from atrocities. But in the face of Syria’s bloody dismemberment and Ukraine’s cynical dismantlement, idealism of that kind looks fluffy or simply irrelevant. The Baltic countries are front-line states once again. The fleeting post–Cold War dream of a zone of unity and peace stretching from Lisbon to Vladivostok has died. As John Mearsheimer observes in his seminal The Tragedy of Great Power Politics, “Unbalanced multipolar systems feature the most dangerous distribution of power, mainly because potential hegemons are likely to get into wars with all of the other great powers in the system.”

In this context, nothing is more dangerous than American weakness. It is understandable that the United States is looking inward after more than a decade of post-9/11 war. But it is also worrying, because the credibility of American power remains the anchor of global security. The nation’s mood is not merely a reflection of economic hardship or the costs of war; it is also determined by the president’s decisions and rhetoric. There was no American majority for involvement in World War I or World War II—until the president set out to forge one (helped decisively in Franklin D. Roosevelt’s case by Pearl Harbor). As Jonathan Eyal of Britain’s Royal United Services Institute says, “If a president stands up and says something, he can shift the debate.”

President Obama has made clear he does not believe in military force. His words spell that out; so does his body language. He asks, after Iraq and Afghanistan, what force accomplishes. These are fair questions; the bar must be very high for unleashing military power. But when an American president marches allies up the hill to defend his “red line”—as Obama did regarding Syria’s use of chemical weapons—and then marches them back down again, he does something damaging that the world does not forget. And when Obama, in response to a recent question about whether declaring that the United States would protect the Senkaku Islands risked drawing another “red line,” gives an evasive answer, he does something so dangerous that his words are worth repeating:

The implication of the question, I think, … is that each and every time a country violates one of these norms, the United States should go to war or stand prepared to engage militarily, and if it doesn’t, then somehow we’re not serious about these norms. Well, that’s not the case.If these treaty obligations do not constitute a red line triggering a U.S. military response—the only way to prove the seriousness of “these norms”—all bets are off in a world already filled with uncertainties. A century ago, in the absence of clear lines or rules, it was just this kind of feel-good hope and baseless trust in the judgment of rival powers that precipitated catastrophe. But that, it may be said, was then. The world has supposedly been transformed.

But has it? Consider this article in my father’s 1938 high-school yearbook:

The machine has brought men face to face as never before in history. Paris and Berlin are closer today than neighboring villages were in the Middle Ages. In one sense distance has been annihilated. We speed on the wings of the wind and carry in our hands weapons more dreadful than the lightning … The challenge of the machine is the greatest opportunity mankind has yet enjoyed. Out of the rush and swirl of the confusions of our times may yet arise a majestic order of world peace and prosperity.Optimism is irrepressible in the human heart—and best mistrusted. Our world of hyperconnectivity, and the strains and aspirations that accompany it, is not so novel after all. The ghosts of repetition reside alongside the prophets of progress. From the “rush and swirl” of 1938 where “distance has been annihilated” would follow in short order the slaughter of Stalingrad, the mass murder of European Jewry, the indiscriminate deaths in Hiroshima and Nagasaki, and the anguish of all humanity. We should not lightly discard a well-grounded pessimism or the treaties it has produced.

30 July 2014

Prices have close below the said trend line support. It has also closed below the 200ma on the 60min chart. The last time it closed below the 200ma line on the 60min chart, we urged people to watch a straight closing below it for at least 3 hrs before a confirmation that it would go lower, but it did not and ended up gaping up the next day. This type of analysis would apply again and we need to see it close for at least 3 consecutive hours. The EW count from the high on a bearish scale could count as a 1-2, 1-2. With this scenario, we would see things accelerate to the downside. The bullish alternative is that we have seen an a-b-c retracement and ready to move higher. Nothing has changed from our indicators and have retained our short position.

MT: DOWN

ST: DOWN

PA: DOWN

MT: DOWN

ST: DOWN

PA: DOWN

Tuesday 29 July 2014

29 July 2014

The SPX is still supporting near the critical trend line I outlined a few days ago and this would be a make it or break it for the bears. The moving averages on the 60min chart seems to hug this trend line showing some importance. My feeling is that we break this line as it has tried multiple times and must eventually break. That said, it is not a great analysis when all it is is just a feeling. Our indicators still remains down and should be followed for the short term turns.

MT: DOWN

ST: DOWN

PA: DOWN

MT: DOWN

ST: DOWN

PA: DOWN

Monday 28 July 2014

28 Jul 2014

The price for the SPX has supported near the indicated support range, and have caused a bounce up. The key here is the 60min chart where a potential resistance exists and would need to push and make lower lows. But the 60min trend right now is in a bullish trend, therefore we need to make sure that the 60min trend syncs with the moves made by the daily and weekly charts. The PA indicator was put on a downward momentum, and it did happen, yet prices also manage to cover the accelerated price made in the morning turning the move bullish with a hanging candle having been formed on the daily chart.

MT: DOWN

ST: DOWN

PA: DOWN

MT: DOWN

ST: DOWN

PA: DOWN

Saturday 26 July 2014

25 July 2014

I am traveling this month and I do not have access to a very good data feed or limited to my laptop. Therefore I will try my best to do a daily analysis of the market. Everything should be back to normal by the end of August.

The patterns I see for the past week to current seems to point to my wedging views. The ST has had a change of heart yet once again, and this can be expected with volatility. Patience is the key with an eventuality that the zigzagging trends will turn and will be followed with large moves capable of large profits.

MT: DOWN

ST: DOWN

PA: DOWN

Our MT is still diverging negatively with the SPX prices... This should be a concern for the near-term until indicators resets.

The patterns I see for the past week to current seems to point to my wedging views. The ST has had a change of heart yet once again, and this can be expected with volatility. Patience is the key with an eventuality that the zigzagging trends will turn and will be followed with large moves capable of large profits.

MT: DOWN

ST: DOWN

PA: DOWN

Our MT is still diverging negatively with the SPX prices... This should be a concern for the near-term until indicators resets.

Wednesday 23 July 2014

23 July 2014

And the higher highs continue. So does the pattern, and it's looking like a wedging formation is taking shape which we could see turn into a 5 wave pattern of sorts. For now then, we will remove the bearish case scenario and start looking for a possible top to this market.

MT: DOWN

ST: UP

PA: NA

MT: DOWN

ST: UP

PA: NA

Tuesday 22 July 2014

22 Jul 2014

New all time high for SPX. So what does that tell us? Well, on a bullish perspective it is and should make a complete 5 wave pattern, and only if we see a shift in an impulsive manner to the downside do we initiate a CIT. As for the bears, one may think that this is a dagger to the chest. Well, not so... As with EW it is always in constant motion and so are the possibilities of the counts. As the waves develop and patterns get crossed out others appear. In this case we could see a potential C wave down even with this move higher in the SPX as noted in the 15min chart below.

MT: DOWN

ST: UP

PA: NA

I mentioned a while ago that volatility will warp the accuracy of the ST, and the clustering of it on our 60min chart shows just that. The eventual clarity will show itself but for now I have to believe that patience will pay off.

60min Bullish Count:

MT: DOWN

ST: UP

PA: NA

I mentioned a while ago that volatility will warp the accuracy of the ST, and the clustering of it on our 60min chart shows just that. The eventual clarity will show itself but for now I have to believe that patience will pay off.

60min Bullish Count:

15min Bearish Alternative:

Monday 21 July 2014

21 July 2014

The MT indicator has closed on a bearish note for 2 weeks and we are still negatively diverging. We should see if the ST will give us that impulsive move to the downside to kick things off. We presented last week a bearish alternative that could play out but it would have to break the lower trend line that is giving a good case for a triangle and a risk for higher highs at the moment.

MT: DOWN

ST: DOWN

PA: NA

Bearish Alternative:

MT: DOWN

ST: DOWN

PA: NA

Bearish Alternative:

Friday 18 July 2014

A BEARISH ALTERNATIVE

The chart below shows another alternative that could possibly play out but cannot exceed the Jul 3rd high. Prices must remain below it to adhere to EW principle of not breaching below the start of the initial wave. If so then the Bears are still alive for the moment. A push hard lower and past the previous lows will confirm a struggling bull market possibly ready for a good sized correction.

The Dow Jones Financials have reached or is nearing the 61.8% retracement.

18 July 2014

Prices we discussed yesterday about closing for 3 consecutive hours below the 60min charts 200ma needed to happen for the bears to retain certainty. The open quickly erased that scenario and pushed prices in an accelerated momentum and all about erased yesterdays loss. The bulls are not done and they are fighting teeth and nail to keep the momentum going their way.

It is possible the triangle is still forming, and we can be certain about the pattern, but not the count. The push higher today will certainly alter the ST next week and as I have said in the past, volatility like this will distort the ST's results. Eventually though everything will clear up, and so all we need to do is play it out or wait it out.

MT: DOWN

ST: DOWN

PA: NA

As you can see our MT has been on the down-trend indicator, and is a sign of a divergence so long as it remains down and price continue higher.

It is possible the triangle is still forming, and we can be certain about the pattern, but not the count. The push higher today will certainly alter the ST next week and as I have said in the past, volatility like this will distort the ST's results. Eventually though everything will clear up, and so all we need to do is play it out or wait it out.

MT: DOWN

ST: DOWN

PA: NA

As you can see our MT has been on the down-trend indicator, and is a sign of a divergence so long as it remains down and price continue higher.

Thursday 17 July 2014

17 July 2014

There were indications midday that the market was weak and a potential to push lower. The last hour provided the push lower and pierce the level I said would be important for an extended push lower. This level is the 60min charts 200ma @ 1958.96 and we closed at 1958.12. Although close, we can assume that a close below it should signal more downside. I would apply the rules here that it would need for the 3rd candle bar to close below the 60min charts 200ma. So tomorrow we should see where the 3rd hour resides or if we continue in an impulsive manner lower which would become evident by then.

MT: DOWN

ST: DOWN

PA: NA

Notice that our ST has turned to bearish...

MT: DOWN

ST: DOWN

PA: NA

Notice that our ST has turned to bearish...

INTRA-UPDATE

3:45 pm - 1953 SPX support lower trend line channel

12:00 pm - The market is showing some weakness. Be careful with long positions. Prices have been having a hard time climbing and met with resistance for a few days now. If 1958 is broken, then expect more downside...

12:00 pm - The market is showing some weakness. Be careful with long positions. Prices have been having a hard time climbing and met with resistance for a few days now. If 1958 is broken, then expect more downside...

Wednesday 16 July 2014

16 July 2014

Triangle on my part is confirmed, although some do not agree with my count. It did make 3 wave patterns where no one saw that it could. It did consolidate the way a triangle should and no one saw it coming, and it did move higher after our E-wave count. Therefore I found it to be helpful. So do we have a failed 5th developing or do we have sub-waves forming for higher highs and new highs. Our ST was also twisting and turning with the volatility and it does happen from time to time, but once a trend has been caught, there is no denying the profits it can make for you.

MT: DOWN

ST: UP

PA: UP

MT: DOWN

ST: UP

PA: UP

Tuesday 15 July 2014

15 July 2014

As I see it, the triangle pattern seems to still be intact. Just in case that we are wrong on our counts, we do see a possibility that an impulsive move down tomorrow might classify the last few days of rise as a failed 5th, but I'm not relying on this heavily. Our ST still points up, therefore stay the course till it says otherwise. There will always be lots of opportunity to play the downside if indeed we have a CIT.

MT: DOWN

ST: UP

PA: UP

MT: DOWN

ST: UP

PA: UP

Monday 14 July 2014

14 July 2014

The triangular formation we were anticipating is still in play on this upside, and a substantial upside at that. From the looks of the last hour we can see more upside potential for tomorrow. The July 9th high was breached and I can say that higher highs are in play. Also our ST today has changed to an uptrend, and giving more credibility to the breach of the July 9th high analysis of a higher high.

A continued, move to the upside will throw the pattern off, but it is not as important right now since we have a confirmed an ST "UP".

MT: DOWN

ST: UP

PA: UP

Alternative: 5th wave higher high ending pattern...

A continued, move to the upside will throw the pattern off, but it is not as important right now since we have a confirmed an ST "UP".

MT: DOWN

ST: UP

PA: UP

Alternative: 5th wave higher high ending pattern...

Friday 11 July 2014

11 July 2014

There is a possible new development, but more on that in a bit. Lets talk about what happened today and the past few days that transpired. Today's action did not do much for markets, and it appears on the 60min chart that prices are testing the underside of the lower channel line I spoke of a few days ago as being a line the bears need to cross to sustain more down pressure. (refer to 60min chart below in green dotted line). The Bears line has now shifted from that lower trend-line to the low made on July 10th. This is also the approx. 200ma of the 60min chart. Therefore a break needs to be made next week below the low I just mentioned or the bulls can carry the consolidating pattern to new highs.

I know for some cycle analyst, that the top is in and for some, that a CIT had occurred. I am not willing to bet the farm on these setups where there are possible doubts or holes that cannot be explained. Until then the indicator is still my main concentration, and thus far is on a downward bias. Anything can happen over the weekend so be on your toes.

You will notice on the 60min chart that there is a reaction near the 15th of July (Red highlighted vertical bar), but this could stretch to the 24th. The possibilities of an acceleration up within the next week has great potential. So again, the low made on July 10th is critical in my views.

The triangular scenario in (blue dotted line) is the new development I would like to talk about now, and it has merit. Near the beginning of the week I mentioned that I could have counted the rise up to new highs the wrong way or that it is in fact a corrective pattern due to it falling short of completing a full wave structure. It now dawned on me that the rise up could potentially be "corrective", and is a 3 wave structure but just not evident to the naked eye (see July 8th post). Because we are counting in a intra-day or sub-wave level, one can get lost in the up-ticks and down-ticks of the prices. We do however still need to keep an eye on it as a possibility if one is short the market. If we do rise next week to touch the upper trend line of the blue dotted line triangle, we could also be setting up bears for a fake head and shoulder, thus I warn of the potential break of the high made on the 9th of July as critical for Bulls to break to keep the ongoing pattern a consolidating corrective pattern (See 15min chart).

Ok.. So now that I have confused you, we can try to mull it over the weekend. lol.

MT: DOWN

ST: DOWN

PA: NA

15min:

60min:

Note: I have always tried to forecast an Elliott Wave Pattern before it is evident, and sometimes it happens because we keep an open mind. Sometimes, once the pattern or count is evident, it could also back fire because too many see it as such. Elliott Wave is hard enough to count, but it is great when you are able to anticipate its move and that's what makes wave counting exciting. Would I say it is accurate? The odds are against you is all I have to say... So the important takeaway from this is the July 9th high and the July 10th low. These are the range to break for both bulls and bears.

I know for some cycle analyst, that the top is in and for some, that a CIT had occurred. I am not willing to bet the farm on these setups where there are possible doubts or holes that cannot be explained. Until then the indicator is still my main concentration, and thus far is on a downward bias. Anything can happen over the weekend so be on your toes.

You will notice on the 60min chart that there is a reaction near the 15th of July (Red highlighted vertical bar), but this could stretch to the 24th. The possibilities of an acceleration up within the next week has great potential. So again, the low made on July 10th is critical in my views.

The triangular scenario in (blue dotted line) is the new development I would like to talk about now, and it has merit. Near the beginning of the week I mentioned that I could have counted the rise up to new highs the wrong way or that it is in fact a corrective pattern due to it falling short of completing a full wave structure. It now dawned on me that the rise up could potentially be "corrective", and is a 3 wave structure but just not evident to the naked eye (see July 8th post). Because we are counting in a intra-day or sub-wave level, one can get lost in the up-ticks and down-ticks of the prices. We do however still need to keep an eye on it as a possibility if one is short the market. If we do rise next week to touch the upper trend line of the blue dotted line triangle, we could also be setting up bears for a fake head and shoulder, thus I warn of the potential break of the high made on the 9th of July as critical for Bulls to break to keep the ongoing pattern a consolidating corrective pattern (See 15min chart).

Ok.. So now that I have confused you, we can try to mull it over the weekend. lol.

MT: DOWN

ST: DOWN

PA: NA

15min:

60min:

Note: I have always tried to forecast an Elliott Wave Pattern before it is evident, and sometimes it happens because we keep an open mind. Sometimes, once the pattern or count is evident, it could also back fire because too many see it as such. Elliott Wave is hard enough to count, but it is great when you are able to anticipate its move and that's what makes wave counting exciting. Would I say it is accurate? The odds are against you is all I have to say... So the important takeaway from this is the July 9th high and the July 10th low. These are the range to break for both bulls and bears.

Thursday 10 July 2014

10 July 2014

The lower low made today by the market did not make the picture any clearer other than the fact it was impulsive. In EW the pattern looks to be an a-b- and c which and should be impulsive in manner. So the question now is if this is the low in place or is the impulsive move down today is a sub-wave (i) of a 3rd wave. In which case is valid due to its impulsive nature. So many possibilities...

Yesterday my bias is on the downside and today, my views has not changed. The only thing holding this bias back is the fact that the candle made a reversal on the daily chart, but does not mean that it always turns out. Lets not pick bottoms here rather lets react to what markets tell us tomorrow... A continued lower price lets us steady the course, and a push higher should not violate yesterdays high.

MT: UP

ST: DOWN

PA: NA

Yesterday my bias is on the downside and today, my views has not changed. The only thing holding this bias back is the fact that the candle made a reversal on the daily chart, but does not mean that it always turns out. Lets not pick bottoms here rather lets react to what markets tell us tomorrow... A continued lower price lets us steady the course, and a push higher should not violate yesterdays high.

MT: UP

ST: DOWN

PA: NA

Wednesday 9 July 2014

9 July 2014

Great rally for the Bulls today, but patterns seem corrective. Although I have been wrong before, the zigzagging affair upwards has a high probability of corrective attitude regardless of EW counts. Our bias is still to the downside based on our ST indicating a downward trend.

At the moment, prices have bounced off of the 75ma line on the 60min chart, and the Bears would need to break that level to have a foothold on more sustained downtrend. By breaking this ma, prices would also break a channel that has been in place since Mid-June. If the line is broken the next level would be 1950 on the SPX.

MT: UP

ST: DOWN

PA: NA

At the moment, prices have bounced off of the 75ma line on the 60min chart, and the Bears would need to break that level to have a foothold on more sustained downtrend. By breaking this ma, prices would also break a channel that has been in place since Mid-June. If the line is broken the next level would be 1950 on the SPX.

MT: UP

ST: DOWN

PA: NA

Tuesday 8 July 2014

8 Jul 2014

Our ST turned negative right at the market open. The EW pattern though cannot be confirmed as a complete 5 wave which would have increased the chance for a CIT. Therefore at the moment, it cannot be ruled out that this is just a corrective wave pattern and that higher highs are still in place.

Since the ST has moved to a negative and down-trending signal, we should keep short until we have a reversal or a momentum confirmed to the downside.

It is hard to assess if the pattern formed during the 26th of June to the 7th of July is a corrective pattern of sort. The move down from yesterdays high seems to be too deep yet we have not violated what we deem to be wave - 1 (Green). I can only say that we need more time for the pattern to complete based on EW or that I am wrong in the count and the move up during late June to early July is indeed corrective and is an ongoing structure that is longer in time. The possibilities of the EW pattern has expanded, therefore I will just skip this until I get more clarity. Our ST is still the one to follow regardless.

On a daily scale, we have a negative divergence that developed just before the move this morning. This on a daily basis is bearish and should last a few days at the "least". We are just shy of touching the upper trend line that has been guiding prices in a channel since May and June of 2013. So with our market sentiment still being bullish longer term, there is still a good chance that prices will still make their way upwards in the near future. I will update when sentiments have changed...

MT: UP

ST: DOWN

PA: NA

Daily:

Since the ST has moved to a negative and down-trending signal, we should keep short until we have a reversal or a momentum confirmed to the downside.

It is hard to assess if the pattern formed during the 26th of June to the 7th of July is a corrective pattern of sort. The move down from yesterdays high seems to be too deep yet we have not violated what we deem to be wave - 1 (Green). I can only say that we need more time for the pattern to complete based on EW or that I am wrong in the count and the move up during late June to early July is indeed corrective and is an ongoing structure that is longer in time. The possibilities of the EW pattern has expanded, therefore I will just skip this until I get more clarity. Our ST is still the one to follow regardless.

On a daily scale, we have a negative divergence that developed just before the move this morning. This on a daily basis is bearish and should last a few days at the "least". We are just shy of touching the upper trend line that has been guiding prices in a channel since May and June of 2013. So with our market sentiment still being bullish longer term, there is still a good chance that prices will still make their way upwards in the near future. I will update when sentiments have changed...

MT: UP

ST: DOWN

PA: NA

Daily:

Monday 7 July 2014

7 July 2014

Markets had a brief pause today. The 4th Sub-wave is still in play and could push higher once a 3 wave correction is confirmed. Our indicator still shows a up-trending market, therefore there is no reason to suggest a turn.

MT: UP

ST: UP

PA: UP

MT: UP

ST: UP

PA: UP

Thursday 3 July 2014

3 July 2014

Acceleration is the name of the game. Dow made a new all-time high along with the already high SPX. Every index is joining the higher high bandwagon day by day. Seems like the REAL jobs number of 12.1% unemployment rate wasn't putting any fear into investors psyche. Well, at least there is enough money for fireworks.

MT: UP

ST: UP

PA: UP

MT: UP

ST: UP

PA: UP

Wednesday 2 July 2014

2 July 2014

The push up in prices for the markets especially for the SPX over the Canadian holiday sure did some damage to the bears. I believe this run up is not over, and the bears are still hurting. Counting this EW pattern leads me to believe we are still on a sub-wave 3 of 3 and likely wont be done for this week. The scenario I labelled as one of the plausible EW count (1-2, i-ii in green) did come true and based on this analysis, I don't see why we should stray away from it. We also called for price acceleration on June 30 EOD, and anyone listening could have made some money or pulled out of their short position.

Market: BULLISH (This will be a new feature that I will add from now on, and although lagging should be accurate enough for a bigger picture of what is happening in the markets of bulls and bears.) This sentiment has been bullish since

November 2012.

MT: UP

ST: UP

PA: UP

15min:

60min:

Market: BULLISH (This will be a new feature that I will add from now on, and although lagging should be accurate enough for a bigger picture of what is happening in the markets of bulls and bears.) This sentiment has been bullish since

November 2012.

MT: UP

ST: UP

PA: UP

15min:

60min:

Subscribe to:

Posts (Atom)