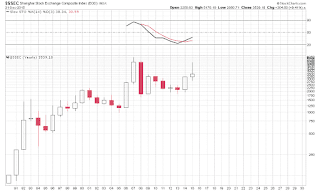

Price is now at 61.8% if wave-a (blue). Although the possibility of a resistance here is high, the intra-day indicator is now at OB and with an ST still up-trending, it does seem to have more risk of higher prices. The lower move that I discussed yesterday did not come to fruition so this EW count down is now void. We will see next week if we will see this C-blue become a run-away situation targeting the 50% ret. from the Nov. 2015 highs to this years low at 1963.

The month end closes with a tail to show a possible low in place but our mid-term signal needs to show a bullish sentiment for us to confirm this possible monthly reversal bar. Most importantly though, the close today in the monthly bar will not change the indicators trend which will now print with a downside bias. So even though a market can turn up on a bearish indicator, what is important to take from this is the "RISK" involved. Every bar can produce a tail, every pattern can look corrective, but weighing the risk is the best alternative when putting in a trade, and to follow that with consistency can result in success. Add to this the fact that the 75ma of the monthly chart is now reaching the 1600 level will be a good magnet for prices if it happens to break down from current support. This 1600 is only surpassed by the 1550 target that the current high to support is featuring (also to some a possible H&S). This 300 plus pts. will possibly have us in a scenario where price drops so fast that it will tag the lower end of the target but close on a monthly at or around the 1600 level where the moving averages resides.

The above is only speculation, but we can plan ahead and watch for this possibility. Keeping with the same analysis, I also added a possible agreement on M. Armstrong's recent blog where he is looking for a flush out before a move to bullish ATH. The article can be found HERE.

SEN: Bearish

ST: UP

PA: UP

NOTE: Although we can see from reading the above analysis that a possible bottom can be had or can happen soon, we cannot rule out the bearish case where the market just collapses and never finds footing for a sustained bounce. But this is what our indicators are for, and if you have trusted the indicator since June 9th of last year, you would have been unscathed by the volatile market.

“Those who have knowledge don’t predict. Those who predict don’t have knowledge.”

Lao Tzu, Chinese philosopher, 6th century BC

PAYPAL

Friday 29 January 2016

Thursday 28 January 2016

28 Jan 2016 - A Bit More Detail

Seems prices are subdividing patterns and time. While we are in following two strong possible EW patterns, it seems that we have to wait a while longer for the true intention of the market. The sideways movement of the market today suggest that a lower price is setting up, but the anticipated lower move can be an extension of a c-wave of B.

The ST has not changed its direction and we should look for a higher prices eventually once this small sideways move is over, unless we get a change soon to the downside.

SEN: Bearish

ST: UP

PA: NA

The ST has not changed its direction and we should look for a higher prices eventually once this small sideways move is over, unless we get a change soon to the downside.

SEN: Bearish

ST: UP

PA: NA

Wednesday 27 January 2016

27 Jan 2016 - Correction Extended?

This part of EW counting is the hardest due to the multiple possibilities of the sub-waves. The 5min chart I provided on Monday is still in play but the variations of the coming price trends have multiplied as seen on the updated 5min chart below. If the sub-waves are done we should make an impulsive move lower and break the last low (marked in red dotted trendline). If however, we are still subdividing, we should see price rise into the resistance we noted on our 60min chart. Since A=C is common, it is not guaranteed to always happen, but having this option, we can anticipate where the C-wave should start to the upside (seen on the 60min chart).

Plan accordingly, and be aware of the options available to you.

SEN: Bearish

ST: UP

PA: NA

Plan accordingly, and be aware of the options available to you.

SEN: Bearish

ST: UP

PA: NA

Tuesday 26 January 2016

26 Jan 2016 - Facing Resistance

Price did rise as per yesterdays blog, but it seems to be facing resistance at current levels. This would not be close to the analysis I had yesterday and would need for price to break up and out of this level to fulfill the rally. As the market is bearish, caution should be taken for those who like to dip-buy. I have mentioned this before, but since we are getting the FED meeting and talking, anything can happen, but the larger risk remains to the downside due to the "Sentiment" which if you followed since June 2014, has had major impulsive moves to the downside even when there was a rally. This is what the bulls are faced with now, and there are no confirmation yet of a bullish turn-a-round that could be lasting.

SEN: Bearish

ST: UP

PA: UP

The 60min 75MA is holding price at bay, but a break above tomorrow will accelerate things to the upside. A turn down in the signal and into bearish territory is a possible entry point for shorts.

SEN: Bearish

ST: UP

PA: UP

The 60min 75MA is holding price at bay, but a break above tomorrow will accelerate things to the upside. A turn down in the signal and into bearish territory is a possible entry point for shorts.

Monday 25 January 2016

25 Jan 2016 - Has The Correction Ended?

The pattern seems to show a corrective price move from the lows made last week, but knowing precisely if it has ended is a bit difficult in that a sub-division is possible, The move lower today also doesn't seem too impulsive, and will have to see more development into open trade tomorrow to have an idea of how the price outcome will affect the analysis.

Current intra-day chart signaled a bearish start at 8:30 am in the futures market, and will close bearish. If the open tomorrow can sustain a push lower the ST might be at risk of turning down as well. Thus far the intra-day signals will only be effective for a few hours, and is not considered long-term. But day traders can take advantage of these signals, while swing traders wait for the ST to change its stance. Perhaps this draw down from this morning is a sub-dividing B-wave with a C-wave up to come. This is of course speculative, but nevertheless a possibility...

SEN: Bearish

ST: UP

PA: NA

If the count above is the case then the impulsive move in the late hour sell-off makes perfect sense.

If the rally extends then find resistance at the 50% ret. or the down trending blue-dotted line.

Current intra-day chart signaled a bearish start at 8:30 am in the futures market, and will close bearish. If the open tomorrow can sustain a push lower the ST might be at risk of turning down as well. Thus far the intra-day signals will only be effective for a few hours, and is not considered long-term. But day traders can take advantage of these signals, while swing traders wait for the ST to change its stance. Perhaps this draw down from this morning is a sub-dividing B-wave with a C-wave up to come. This is of course speculative, but nevertheless a possibility...

SEN: Bearish

ST: UP

PA: NA

If the count above is the case then the impulsive move in the late hour sell-off makes perfect sense.

If the rally extends then find resistance at the 50% ret. or the down trending blue-dotted line.

Friday 22 January 2016

22 Jan 2016 - Not Convinced, But follow Signal

There is no use trying to force your views on how the markets might move. The market does not care...

I believe that the prices are moving higher but still in a corrective phase, but the ST has now moved out of OS and is also trending UP. This is a good sign in the short term, and we should take some covered profits and re-enter when conditions are favourable to short a bearish market. Remember that you should not worry too much about catching tops and bottoms but to recognize that a trend has changed.

Prices in the SPX is now right under the 60min. charts 75 MA. We should also remember that on a fundamental view, many of these equities will start reporting soon, and could show erratic behaviour. On a daily time frame, prices closing at this price level (1906.90) is no surprising as it is the resistance to an imaginary line that has placed support to price for the past year, and has been respected by price by way of a quick bounce right after the quick dip below 1900. This range should be watched carefully in the next few trading days to see if this holds up or breaks down.

On a lighter and bullish note, the weekly candle bar is sporting a reversal. This after 3 weeks of decline. I have mentioned in the FREE report last night that the signal needs to reverse or be at risk of pushing price to a CRASH scenario. While not totally bullish, the candle does give a bit of relief to bulls. The 200 Week MA is also inching higher and at 1782 level at this weeks closing.

SEN: Bearish

ST: UP

PA: NA

I believe that the prices are moving higher but still in a corrective phase, but the ST has now moved out of OS and is also trending UP. This is a good sign in the short term, and we should take some covered profits and re-enter when conditions are favourable to short a bearish market. Remember that you should not worry too much about catching tops and bottoms but to recognize that a trend has changed.

Prices in the SPX is now right under the 60min. charts 75 MA. We should also remember that on a fundamental view, many of these equities will start reporting soon, and could show erratic behaviour. On a daily time frame, prices closing at this price level (1906.90) is no surprising as it is the resistance to an imaginary line that has placed support to price for the past year, and has been respected by price by way of a quick bounce right after the quick dip below 1900. This range should be watched carefully in the next few trading days to see if this holds up or breaks down.

On a lighter and bullish note, the weekly candle bar is sporting a reversal. This after 3 weeks of decline. I have mentioned in the FREE report last night that the signal needs to reverse or be at risk of pushing price to a CRASH scenario. While not totally bullish, the candle does give a bit of relief to bulls. The 200 Week MA is also inching higher and at 1782 level at this weeks closing.

SEN: Bearish

ST: UP

PA: NA

Thursday 21 January 2016

21 Jan 2016 - Weak Lookin'

Price didn't do much moving today regardless of a intra-day OB situation. If this case for a bull run is strong, it should have taken advantage of the OB to accelerate price to the upside, but it did not. The daily candle does not look like a confidence builder, sporting a reversal candle and below the Gann angle that I am following. The long-term OS is still in play, and maybe the cause for the weak OB signal on the intra-day charts. This is still under study to see reactions opposite each extremes.

Since I have an 1800 target that was not hit, it is possible price is still working through some pressure before a resumption lower.

SEN: Bearish

ST: DOWN

PA: DOWN

WARNING: Impulsive move down has occurred, but it could get worse if we do not exit OS on ST. (Crash Scenario)...

NOTE: Email me for a FREE special report: (Report has expired, it was a good turnout and thankful for the great feedbacks)

Since I have an 1800 target that was not hit, it is possible price is still working through some pressure before a resumption lower.

SEN: Bearish

ST: DOWN

PA: DOWN

WARNING: Impulsive move down has occurred, but it could get worse if we do not exit OS on ST. (Crash Scenario)...

NOTE: Email me for a FREE special report: (Report has expired, it was a good turnout and thankful for the great feedbacks)

Wednesday 20 January 2016

20 Jan 2016 - Oh So Close..

I was looking for 1800 in the SPX which was 12.29 pts. off. While the rally look to turn things around, the market sentiment and direction has not changed. The volatility and over-reaction is not something to be surprised about. If this is just a release of downside pressure, it surely did a good job. But damage in an EW count has been done. The scenario that this possible move down was a W-2 of a final push higher is now nullified. It's not to say that this is not a possibility, but the count will now have to be prolonged as the higher chance of a count will belong to a 4th wave C before a push higher into ATH territory. But because I am bearish I am only labeling the chart with bearish counts for now.

No matter what the count is, the signal will be the one to follow. Be aware that the signal is still OS,..

SEN: Bearish

ST: DOWN

PA: DOWN

No matter what the count is, the signal will be the one to follow. Be aware that the signal is still OS,..

SEN: Bearish

ST: DOWN

PA: DOWN

Tuesday 19 January 2016

19 Jan 2015 - Current Progress

Progress of the pattern is still corrective, suggesting more bearishness and possibility of lower lows. While the rally into close is impressive as a reversal, it is but a blip in a longer trending bearish road. We should see a low soon, but at this time it is pointless to bottom feed with high risk abound.

SEN: Bearish

ST: DOWN

PA: DOWN

SEN: Bearish

ST: DOWN

PA: DOWN

Friday 15 January 2016

15 Jan 2016 - Trapped On The Pullback

"I can't stress enough also, that we are still OS, and this is high risk for acceleration down, and rallies like today are risky because a reversal can quickly leave you trapped holding a loss. So until we can get out of the OS position and confirm at least a short term bullish sentiment, we should remain bearish." Jan 14, 2016 post.

So again, longs trying to trade for a few pts. got trapped today as it opened where it started yesterday erasing gains or holding a losing position. The pattern that formed today looks bearish still and I could be wrong by saying that we could see one more low before a bottom can be had, but with the sentiment and direction of the ST agreeing with my theory, I say the risk is minimal for being short.

Look for the intra-day to put in a positive divergence next week if we are to have a bottom of sorts. Any exit of the OS condition warrants profit taking, but for those risk averse I would say you might want to reconsider taking profits once the indicator turns bullish.

SEN: Bearish

ST: DOWN

PA: DOWN

The market is at risk now more than in August of 2015. This should not be taken lightly, and on top of the signals ever more bearish now than in August, we have not seen these bearishness or condition since 2011. When do we start seeing that sentiments are now going back further in time for comparisons to the situation that we are in now. Shouldn't this be a clue? I was pretty sure the clue I provided can be seen to the right of the page where it has not changed since June 9th when it signaled bearish and we cautiously followed and most likely rewarded.

If the low is broken next week, then things could get worse if it does not push back up above it with a couple of days time. If so, you should start looking for 1800 to dare I say it 1650. But lets not get ahead of ourselves.

Be aware that the 200 week MA is at 1780, which is not far from where we are now when looking at a weekly chart.

So again, longs trying to trade for a few pts. got trapped today as it opened where it started yesterday erasing gains or holding a losing position. The pattern that formed today looks bearish still and I could be wrong by saying that we could see one more low before a bottom can be had, but with the sentiment and direction of the ST agreeing with my theory, I say the risk is minimal for being short.

Look for the intra-day to put in a positive divergence next week if we are to have a bottom of sorts. Any exit of the OS condition warrants profit taking, but for those risk averse I would say you might want to reconsider taking profits once the indicator turns bullish.

SEN: Bearish

ST: DOWN

PA: DOWN

The market is at risk now more than in August of 2015. This should not be taken lightly, and on top of the signals ever more bearish now than in August, we have not seen these bearishness or condition since 2011. When do we start seeing that sentiments are now going back further in time for comparisons to the situation that we are in now. Shouldn't this be a clue? I was pretty sure the clue I provided can be seen to the right of the page where it has not changed since June 9th when it signaled bearish and we cautiously followed and most likely rewarded.

If the low is broken next week, then things could get worse if it does not push back up above it with a couple of days time. If so, you should start looking for 1800 to dare I say it 1650. But lets not get ahead of ourselves.

Be aware that the 200 week MA is at 1780, which is not far from where we are now when looking at a weekly chart.

Thursday 14 January 2016

14 Jan 2016 - Turning Point?

It seems today would look like a perfect reversal with prices impulsing up impressively. The bulls might have renewed confidence and on an intra-day level things seem to have stabilized. Currently though, while the picture looks calm, the deeper sentiments are still bearish. Gains can be had after such a powerful draw down, and it is no different today. Have we bottomed? Only if our intra-day sentiment changes from bearish to bullish can we confirm this, but due to the far reaching draw down, the signals have been pushed to the extreme that it would take us a while longer to confirm once it has "time" to reach the other side of the bullish border. Make no mistake, we are just up trending on bearishness.

I can't stress enough also, that we are still OS, and this is high risk for acceleration down, and rallies like today are risky because a reversal can quickly leave you trapped holding a loss. So until we can get out of the OS position and confirm at least a short term bullish sentiment, we should remain bearish.

SEN: Bearish

ST: DOWN

PA: DOWN

I can't stress enough also, that we are still OS, and this is high risk for acceleration down, and rallies like today are risky because a reversal can quickly leave you trapped holding a loss. So until we can get out of the OS position and confirm at least a short term bullish sentiment, we should remain bearish.

SEN: Bearish

ST: DOWN

PA: DOWN

Wednesday 13 January 2016

13 Jan 2016 - Hanging Out With The Bears

When in SYNC, today is what happens. Although we had an up trend yesterday, I did mention that we are still in a bearish sentiment. Oh, how quickly all that up trend was erased today even with a green open. Yesterdays call of a corrective rally was the right call, as prices also had a hard time moving above the Gann angle I presented yesterday. With prices closing at 1890 today, I believe personally that we are not out of the woods yet, and that the levels to watch are the 1870 and 1820-1800 after that. These levels are key to anyone looking at EW counts, as it cascades down and eliminates the May high, and Nov. highs as Wave - 1 of a new set of waves up. However, if we do get a support below these levels, a Wave-4 scenario would still exist for bulls. In my views, there is no point in figuring out if this is a W-4 or not as a breach of 1200 or a 3 wave decline would be the only way to confirm this count and by then it would probably be too late.

Instead, lets concentrate at what is reliable... Our sentiment and signals. With the intra-day at OS again, it has renewed its pos. divergence. But the OS acceleration risk supercedes all until the signal exits OS. I failed to mention this past weekend that on a longer term level, the signals created during the Aug. Flash Crash has already been exceeded by the signals made during this down-trend. This means we should be much more bearish now than in Aug. even without a crash present.

SEN: Bearish

ST: DOWN

PA: DOWN

Note: The SPX is now in "Acceleration Risk" to the downside, and even though there could be a bounce happening, we should be aware no to go long until this indicator is out of the risky position.

Instead, lets concentrate at what is reliable... Our sentiment and signals. With the intra-day at OS again, it has renewed its pos. divergence. But the OS acceleration risk supercedes all until the signal exits OS. I failed to mention this past weekend that on a longer term level, the signals created during the Aug. Flash Crash has already been exceeded by the signals made during this down-trend. This means we should be much more bearish now than in Aug. even without a crash present.

SEN: Bearish

ST: DOWN

PA: DOWN

Note: The SPX is now in "Acceleration Risk" to the downside, and even though there could be a bounce happening, we should be aware no to go long until this indicator is out of the risky position.

Tuesday 12 January 2016

12 Jan 2016 - Up On A Bear

Intra-day is suggesting this is a correction as indicator is up-trending on a bearish signal. Short should be initialized when the stoch. signal crosses back down into bearish territory and confirm with an entrance into OS which should accelerate prices to the downside. Until then, the signal Up should be respected and allowed to play out.

SEN: Bearish

ST: DOWN

PA: DOWN

Note: Price still closed under the last Gann angle.

SEN: Bearish

ST: DOWN

PA: DOWN

Note: Price still closed under the last Gann angle.

Monday 11 January 2016

11 Jan 2016 - Reversal Candle Low...

The daily chart seems to have formed a reversal candle low. This is made in the face of an OS condition so risk of an impulsive move down is still high on the list. I do not recommend buying anything for the long side as it would be counter productive to the indicator. If the rally is real or a bull market is starting from any bottom, it would be prudent to get some sort of confirmation. In my own personal opinion and nothing to do with what the chart or indicators are saying now, I believe that prices could break the Aug. lows, therefore a weak rally in the form of a signal that fails to sustain a move into bullish territory is in my view a short trade.

The intra-day charts is up trending on a bearish and accelerative nature.

SEN: Bearish

ST: DOWN

PA: DOWN

The intra-day charts is up trending on a bearish and accelerative nature.

SEN: Bearish

ST: DOWN

PA: DOWN

Friday 8 January 2016

8 Jan 2016 - Risk Reward

"..I would look for a rally as early as tomorrows open at the least. We can confirm this through the intra-day chart again. If the signal fails to come out of the OS condition and eliminates the positive divergence, then expect that a lower low is highly possible. The last time my Sentiment signal was this bearish was back in Aug. 2015, so I would not be surprised if we get a surprised fall. Not to say it would happen, but just an increased risk for one.

If you are on the right side of "Risk" then there will be a greater chance of a "reward". Yesterdays divergence believe it or not is still active even with the drop we had today. But this also kept us OS all day and as it goes, prices will not stay rational at this range. A rally will occur when the intra-day signals push above OS, so watch for this next week. I'm keeping this short because it is as simple as that. At OS anything is possible... Even a "Crash"

Oh and BTW... Weekly bar and signals do not look good with 4 out of 5 days in the red.

SEN: Bearish

ST: DOWN

PA: DOWN

If you are on the right side of "Risk" then there will be a greater chance of a "reward". Yesterdays divergence believe it or not is still active even with the drop we had today. But this also kept us OS all day and as it goes, prices will not stay rational at this range. A rally will occur when the intra-day signals push above OS, so watch for this next week. I'm keeping this short because it is as simple as that. At OS anything is possible... Even a "Crash"

Oh and BTW... Weekly bar and signals do not look good with 4 out of 5 days in the red.

SEN: Bearish

ST: DOWN

PA: DOWN

Thursday 7 January 2016

7 Jan 2016 - Did You Know?

Since Tuesday I have been warning that an acceleration could occur. If you are a daily reader then you were prepared for this move. If you are not, and you want to be ahead of the game, then this blog is for you.. The fact that we become aware of a possible situation can keep us out of trouble, and ready to react to different conditions. Often times a trader or investor is stuck trying to figure out what to do when a certain scenario happens. This usually results into a loss due to indecisiveness, and lack of planning.

If you do not believe in technicals then you are probably hitting up the wrong resources for technical analysis. Here, I keep things simple by concentrating on a few if not one indicator and a few sentiment signals.

Back to the analysis, the intra-day chart did remain in OS range which foresaw an acceleration to the downside. A very good move that even exceeded my expectations of a support at 1960. Normally a few pts. below an expected support is considered successful. But to have a 20 pt. spread is just UGLY. At this point though, the low produced today by the SPX rests on our Gann angle that has been respected by price for a long time. Some might call this a trendline, but this line is one of Gann's square angles.

Be aware that yesterday I mentioned that there was a divergence in place in the intra-day level and have labelled it by mistake as a negative divergence instead of a positive divergence. This divergence is still in place, and I would look for a rally as early as tomorrows open at the least. We can confirm this through the intra-day chart again. If the signal fails to come out of the OS condition and eliminates the positive divergence, then expect that a lower low is highly possible. The last time my Sentiment signal was this bearish was back in Aug. 2015, so I would not be surprised if we get a surprised fall. Not to say it would happen, but just an increased risk for one.

SEN: Bearish

ST: DOWN

PA: DOWN

If you do not believe in technicals then you are probably hitting up the wrong resources for technical analysis. Here, I keep things simple by concentrating on a few if not one indicator and a few sentiment signals.

Back to the analysis, the intra-day chart did remain in OS range which foresaw an acceleration to the downside. A very good move that even exceeded my expectations of a support at 1960. Normally a few pts. below an expected support is considered successful. But to have a 20 pt. spread is just UGLY. At this point though, the low produced today by the SPX rests on our Gann angle that has been respected by price for a long time. Some might call this a trendline, but this line is one of Gann's square angles.

Be aware that yesterday I mentioned that there was a divergence in place in the intra-day level and have labelled it by mistake as a negative divergence instead of a positive divergence. This divergence is still in place, and I would look for a rally as early as tomorrows open at the least. We can confirm this through the intra-day chart again. If the signal fails to come out of the OS condition and eliminates the positive divergence, then expect that a lower low is highly possible. The last time my Sentiment signal was this bearish was back in Aug. 2015, so I would not be surprised if we get a surprised fall. Not to say it would happen, but just an increased risk for one.

SEN: Bearish

ST: DOWN

PA: DOWN

BONUS:

I don't normally forecast long-term charts, but this is becoming intriguing since the last few months of development in pattern and price.

Wednesday 6 January 2016

6 Jan 2015 - Tail End Rallies

Seems to be the norm for end of day rallies to occur. Question is if today's rally happen to move back above a support channel. It is possible that the formation thus far since the Nov. highs have been forming a bullish flag pattern. Therefore, we need to see a rally soon or a break to see where sentiments lie. Tails being produced only reinforces that prices are aware of these support or trend lines as important. The important level is still the 1960 which if broken can cause a few headaches for bullish traders. Something to also keep in mind is that the intra-day chart is producing a negative divergence, so we will need for signals to push out of the OS range tomorrow for this divergence to be confirmed. For now, the signals are OS and possibility of acceleration is to the downside.

The entrance into OS in the last few hours of trading was more subdued than I would have thought, but since we are in the range, we could still see a continuation tomorrow. There is no right or wrong analysis here, but we do need to lay out the scenarios and plan for those that favour our positions.

SEN: Bearish

ST: DOWN

PA: DOWN

The entrance into OS in the last few hours of trading was more subdued than I would have thought, but since we are in the range, we could still see a continuation tomorrow. There is no right or wrong analysis here, but we do need to lay out the scenarios and plan for those that favour our positions.

SEN: Bearish

ST: DOWN

PA: DOWN

Tuesday 5 January 2016

5 Jan 2016 - Watch This Signal

I'm urging people to watch the intra-day signal tomorrow, which could lead to some nice selling if it hits the OS condition. I am looking at this recent move up as corrective, with an addition of an ST that is trending down. Now, we cannot really say this would happen because the intra-day has not confirmed this, and that is why I am urging you to watch the signal for tomorrow. Remember this downside acceleration will only happen when signals are in OS.

SEN: Bearish

ST: DOWN

PA: DOWN

If we push lower, I would then be looking for a 1960 support. If this breaks, then bulls should pray it's not a flash crash...

SEN: Bearish

ST: DOWN

PA: DOWN

If we push lower, I would then be looking for a 1960 support. If this breaks, then bulls should pray it's not a flash crash...

Monday 4 January 2016

4 Jan 2015 - Continuing Where It Left Off

The last trading day of 2015 we discussed the possible outcome today would have due to the ST and the PA trending in the same direction with a year ending Bearish Sentiment. Today's action did not disappoint. While the last minute rally to the close was impressive, the ST is still pointing down.

The SPX has on a daily scale made a series of lower lows and lower highs. This is trending bearishly... So, one needs to be planning for continued trend lower, and protect gains made last year, as the year, month, and weekly (Long-Term) signals has started out in the red. Today's low has also hit our daily Gann angle support. This angle should be observed for any break with a possible support at 1960 or depending on momentum would just push prices to the 1911 lower BB line support on the weekly chart.

The only signal flashing a price acceleration down is at the intra-day level. So a prolonged position in an OS situation would put the longer term charts in a bearish mode and perhaps push them into an acceleration trigger of their own and this could be huge complication to the downside.

SEN: Bearish

ST: DOWN

PA: DOWN

The SPX has on a daily scale made a series of lower lows and lower highs. This is trending bearishly... So, one needs to be planning for continued trend lower, and protect gains made last year, as the year, month, and weekly (Long-Term) signals has started out in the red. Today's low has also hit our daily Gann angle support. This angle should be observed for any break with a possible support at 1960 or depending on momentum would just push prices to the 1911 lower BB line support on the weekly chart.

The only signal flashing a price acceleration down is at the intra-day level. So a prolonged position in an OS situation would put the longer term charts in a bearish mode and perhaps push them into an acceleration trigger of their own and this could be huge complication to the downside.

SEN: Bearish

ST: DOWN

PA: DOWN

Friday 1 January 2016

2015 YEARLY CHARTS AND FOLLOWING

The purpose of this posting is to show us the conditions along the indexes and its health across the world economies, including some PMs, Commodities, and Currencies on a yearly basis (Long Term). So far the only thing I can say to simplify what you need to look at is that the yearly bars for most charts are either a negative reversal candle bar or a continued bearish trend in some markets, but I don't have to point this out to you folks since they are sticking out like a sore thumb.

The good news is, that there is one chart that I found that could have possibly bottomed, and that's NATGAS. Although it's in its early stage, the move or the momentum of the price moving up will depend on how the indicators can quickly move from OS to OB. I think there is something very good potentially setting up for Natural Gas so keep an eye on this.

Keep in mind; Shooting Star, Evening Star, Hammer, Hanging Man, and Harami crosses, are all reversal wordings if you would like to search for the candle patterns that are occurring in these following charts below.

And last but not least, Natural Gas...

the indicator for the monthly chart has not moved out of the OS condition, but an early clue of a positive divergence along with a reversal hammer suggest a possible bottom is in.

Once the 1st trading day of the year starts all indicators for the charts above will change, and could push lower. The only chart making a positive case for more upside is the NASDAQ, but this one market might have a hard time bucking the trend.

The good news is, that there is one chart that I found that could have possibly bottomed, and that's NATGAS. Although it's in its early stage, the move or the momentum of the price moving up will depend on how the indicators can quickly move from OS to OB. I think there is something very good potentially setting up for Natural Gas so keep an eye on this.

Keep in mind; Shooting Star, Evening Star, Hammer, Hanging Man, and Harami crosses, are all reversal wordings if you would like to search for the candle patterns that are occurring in these following charts below.

And last but not least, Natural Gas...

the indicator for the monthly chart has not moved out of the OS condition, but an early clue of a positive divergence along with a reversal hammer suggest a possible bottom is in.

Once the 1st trading day of the year starts all indicators for the charts above will change, and could push lower. The only chart making a positive case for more upside is the NASDAQ, but this one market might have a hard time bucking the trend.

Subscribe to:

Posts (Atom)