ST has its game on yet again. Yesterdays turn was right on cue with todays gap down to OS on the intra-day charts. Large losses for some, and large profit for those who follow their indicators with strict discipline. I believe that any and all indicator works based on analysis, but its the human emotions that get the best of us, and when we do not follow these signals, we fail to blame ourselves and place blame on the indicators for their short comings. They do lag, and they do produce false signals at times, but both of these eventually clear up, so we must trust them, and most of all eliminate emotions.

If the intra-day fails to come out of OS, we could still see more accelerative move lower. Therefore look for an exit or a positive divergence on the intra-day charts for a clue to a rally.

MT: UP

ST: DOWN

PA: DOWN

Yesterday, I mentioned that we "could" be forming a diagonal triangle but could see a high risk of this scenario failing due to an ST signal to the downside. This analysis is based on sound and unbiased analysis and not based on personal belief of what we think should happen.

“Those who have knowledge don’t predict. Those who predict don’t have knowledge.”

Lao Tzu, Chinese philosopher, 6th century BC

PAYPAL

Thursday 30 April 2015

Wednesday 29 April 2015

29 Apr 2015

Prices were not able to stay above their breakout level which leads me to think bids are weak and not confident for a sustainable push higher. Another much more powerful Bradley date come in on May 10th. So we have at least a week of back and forth before any significant price action happens (Up or Down). The pattern higher from The April lows could also be a 3 wave affair on an ending diagonal 5th. But with the ST turning down today we could see this wave possibility fail.

MT: UP

ST: DOWN

PA: NA

Mixed signals are typed out above, and do not lead to any conclusive direction. Look for acceleration of price to indicate direction in tomorrows session.

MT: UP

ST: DOWN

PA: NA

Mixed signals are typed out above, and do not lead to any conclusive direction. Look for acceleration of price to indicate direction in tomorrows session.

Friday 24 April 2015

24 Apr 2015 - Inching Higher

The intra-day charts were inching higher with indicators at OB. The bulls are still in control. I have attached a 2nd chart below that counts differently as a ending fifth wave if prices stair step another 5 waves up. This would complete a 5 wave from the April 17th low.

MT: UP

ST: UP

PA: UP

Potential Ending Top...

This chart was also brought up on April 2nd but I did not account for the pattern to progress for this long or actually be a bigger form of the Apr. 2nd analysis.. Hindsight is always an eye opener, and this is the same reason why EW can be so elusive when it comes to getting a count right.

http://tfaat.blogspot.ca/2015/04/2-apr-2015-another-swing-getting-clearer.html

MT: UP

ST: UP

PA: UP

Potential Ending Top...

This chart was also brought up on April 2nd but I did not account for the pattern to progress for this long or actually be a bigger form of the Apr. 2nd analysis.. Hindsight is always an eye opener, and this is the same reason why EW can be so elusive when it comes to getting a count right.

http://tfaat.blogspot.ca/2015/04/2-apr-2015-another-swing-getting-clearer.html

Thursday 23 April 2015

23 Apr 2015 - 2nd Wave Option

The 2nd wave option was eliminated today when price broke above the highs made in late Feb. With a corrective stance, the other option is that this is a C-wave of a B-wave. Prices on the SPX and Nasdaq could not stay above their highs, and have closed just below it. We need a steady close above this resistance to turn this level into support.

Yesterday, the ST indicator along with the PA turned UP. The trade risk was evident today that momentum was to the upside. We can never know what the market has in store, but if we can decipher what the indicator might be telling us, we can then keep ourselves from a real mess. As the Intra-Day stays in OB, we must assume the risk of acceleration to the upside still exists on the short-term trend.

MT: DOWN

ST: UP

PA: UP

Yesterday, the ST indicator along with the PA turned UP. The trade risk was evident today that momentum was to the upside. We can never know what the market has in store, but if we can decipher what the indicator might be telling us, we can then keep ourselves from a real mess. As the Intra-Day stays in OB, we must assume the risk of acceleration to the upside still exists on the short-term trend.

MT: DOWN

ST: UP

PA: UP

Wednesday 22 April 2015

22 Apr 2015 - Not Bad For Bad Numbers

The pre-market hours started with an impulsive move lower today and had many thinking today was going to be a bad day. Many of those who reported today gave out bad numbers and many warned that the economy will be stagnant for quite a while. While these companies gave warnings, markets continued their stair step upwards contradicting the sentiments. So I guess, Bad news is good news...

This has gone on for a long time and should be no surprise to investors. What is frustrating is the manipulation and the unpredictability of data that is coming out on market performance.

Our ST has turned up today, and should be noted even if we feel bearish on the market. Therefore if you are bearish, you should wait for the indicator to turn down so that your trade is on the right side of the trend. This can be accomplished on an earlier time-frame of your choosing. But do remember that whatever time-frame you are choosing to use as a trigger has a shelf life reflective of itself.

Unless prices can break above the resistance levels, I will remain bearish on the market, and will trade any weakness.

MT: DOWN

ST: UP

PA: UP

Note: Today is a Bradley Turn Date with a power of 53/100. Keep an eye for a top or a continuation.

This has gone on for a long time and should be no surprise to investors. What is frustrating is the manipulation and the unpredictability of data that is coming out on market performance.

Our ST has turned up today, and should be noted even if we feel bearish on the market. Therefore if you are bearish, you should wait for the indicator to turn down so that your trade is on the right side of the trend. This can be accomplished on an earlier time-frame of your choosing. But do remember that whatever time-frame you are choosing to use as a trigger has a shelf life reflective of itself.

Unless prices can break above the resistance levels, I will remain bearish on the market, and will trade any weakness.

MT: DOWN

ST: UP

PA: UP

Note: Today is a Bradley Turn Date with a power of 53/100. Keep an eye for a top or a continuation.

Tuesday 21 April 2015

21 Apr 2015 - Subtle

Are we witnessing a subtle move lower that could run down tomorrow into the Bradley Signal? We had a 60min reversal today and although the rest of the day wasn't anything to rave about, prices were lower and the signals are still looking for more downside. We are clearly seeing a resistance level that the SPX is struggling to break above of for almost two and a half months now. This is clearly an inflection point so keep your cards close to your chest and ready to dish out.

MT: DOWN

ST: DOWN

PA: NA

Look at the intra-day charts tomorrow for clues to the days direction.

MT: DOWN

ST: DOWN

PA: NA

Look at the intra-day charts tomorrow for clues to the days direction.

Monday 20 April 2015

20 Apr 2015 - Volatility Strikes Back

It is hard to say what the pattern is on this impulsive move up, but last week I indicated that a ii-wave (Blue) could retrace close to 100% of the wave- i move. This EW pattern is valid so long as it does not surpass the origin of wave - i. I remind those again that there is a Bradley date on the 22nd of April so we are a day or two away from a possible CIT, which I recommend for everyone to start watching their indicators for weakness or strength.

ST still remains down, but could change tomorrow if prices push higher. Either way there will be answers in the coming days.

MT: DOWN

ST: DOWN

PA: NA

ST still remains down, but could change tomorrow if prices push higher. Either way there will be answers in the coming days.

MT: DOWN

ST: DOWN

PA: NA

Friday 17 April 2015

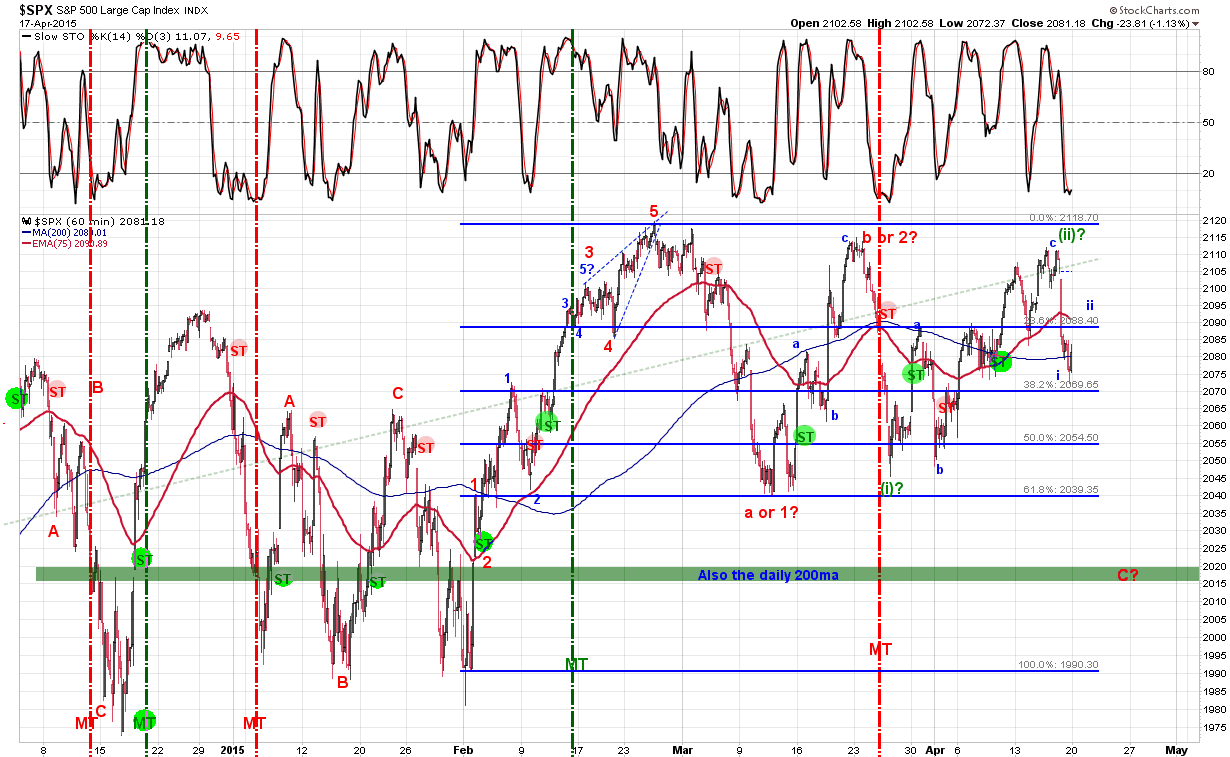

17 Apr 2015 - You Were Warned..

Well.. A bit dramatic for a title, but the point is that this was an expected impulsive move lower. how low will be the question in the coming trading week.

The market wasted no time moving to OS out of the gate in the intra-day charts. This would have been the clue to an accelerative move lower, and possibly signalled earlier on a lower timeframe. The price have bounced back above the 200ma of the 60min chart acknowledging a strong case for a support. This move on an EW could just be a minute move wave-ii so I expect a rally, possibly back to the 60min 75ma or to fill the gap which is all the way up there. I say this because wave 2s in general can retrace almost all of the move of wave 1 (if it is the right count of course). But as part of a bigger picture wave-3 we might just continue where we left off at the close and keep dropping. This is the reason why trends are important, so that you don't get caught on the wrong side of the impulsive or accelerative move.

The ST has also turned down and should indicate a bearish trend for a few days to week depending on how volatile price gets. Some are suggesting that this is a triangulating pattern, therefore we should keep an eye on the trend line connecting the Mid-March low and the April low. Nothing can be taken for granted, and if that trend line happens to break, well then we should look at the next support at 2040 then to the 2020 area where the 200ma on the daily chart sits.

MT: DOWN

ST: DOWN

PA: DOWN

The market wasted no time moving to OS out of the gate in the intra-day charts. This would have been the clue to an accelerative move lower, and possibly signalled earlier on a lower timeframe. The price have bounced back above the 200ma of the 60min chart acknowledging a strong case for a support. This move on an EW could just be a minute move wave-ii so I expect a rally, possibly back to the 60min 75ma or to fill the gap which is all the way up there. I say this because wave 2s in general can retrace almost all of the move of wave 1 (if it is the right count of course). But as part of a bigger picture wave-3 we might just continue where we left off at the close and keep dropping. This is the reason why trends are important, so that you don't get caught on the wrong side of the impulsive or accelerative move.

The ST has also turned down and should indicate a bearish trend for a few days to week depending on how volatile price gets. Some are suggesting that this is a triangulating pattern, therefore we should keep an eye on the trend line connecting the Mid-March low and the April low. Nothing can be taken for granted, and if that trend line happens to break, well then we should look at the next support at 2040 then to the 2020 area where the 200ma on the daily chart sits.

MT: DOWN

ST: DOWN

PA: DOWN

Thursday 16 April 2015

16 Apr 2015

Toppy lookin' from todays price movement. When viewed on a 15min time frame the EW patterns come out to be a 5 wave down from yesterdays high, with a 3 wave rally into mid-day. With the Intra-day charts pointing down and the ST pointing up, there is really no solid views as to the direction. So it is best to wait for both to be in Sync before creating a position. It is possible that we could still see a rise since the ST is still pointing up and giving us an accelerative probability.

MT: DOWN

ST: UP

PA: UP

MT: DOWN

ST: UP

PA: UP

Wednesday 15 April 2015

15 Apr 2015 - ST Intact

Our ST indicator is intact with prices rising to counter the impulsive move down 2 days before. This allowed the signal enough time to stay up thanks in part to the intra-day momentum pushing higher. We must now look at the late Feb. high on the SPX to see if this gets surpassed. If it does then our "Bigger Corrective" count will be in play. This would assume the EW pattern to turn into an impulsive lower but become only temporary rather than a prolonged push lower. Again, there is no sure count out there that can be considered bullet proof or a guarantee, so indicator is key. Lets not get ahead of ourselves here since price is still below the late Feb. and Mar. highs.

If a 3rd wave down is to occur I would say it is now or never...

MT: DOWN

ST: UP

PA: UP

Even if its a C-wave down (Red).. I would be watchful of my long positions as the price has had almost the whole of April and still has not pushed passed the Feb. and Mar. highs.

If a 3rd wave down is to occur I would say it is now or never...

MT: DOWN

ST: UP

PA: UP

Even if its a C-wave down (Red).. I would be watchful of my long positions as the price has had almost the whole of April and still has not pushed passed the Feb. and Mar. highs.

Tuesday 14 April 2015

14 Apr 2015 - Bust A Nut

Well I am sorry for the delay of the daily review. I didn't know what I was thinking when I decided to start to change the suspension on my car at 2pm. I knew there were rusted nuts and bolts but I guess I didn't account for most of them being rusted. On top of that the CV joint slipped out of its bearings and it was such a hassle having to remove the whole hub assembly. Well you live and learn, and I am sure you guys don't want to hear any of this haha.

The movement of price to the upside today negated a possible CIT on the ST signal I mentioned last night. This was expected of any move and close UP in intra-day charts. I mentioned today on Twitter that we might not see any significant trend change until next week since options expire this week and we are pushing towards an April 22 Bradley turn date. Anything can happen I suppose, so lets keep an eye on things if we see a move lower tomorrow.

MT: DOWN

ST: UP

PA: NA

The movement of price to the upside today negated a possible CIT on the ST signal I mentioned last night. This was expected of any move and close UP in intra-day charts. I mentioned today on Twitter that we might not see any significant trend change until next week since options expire this week and we are pushing towards an April 22 Bradley turn date. Anything can happen I suppose, so lets keep an eye on things if we see a move lower tomorrow.

MT: DOWN

ST: UP

PA: NA

Monday 13 April 2015

13 Apr 2015 - Good Reversal But Is This It?

If prices today opened just above last weeks close and closed today under last weeks low we could have had a good case for a reversal or at least a stronger case. Today saw us just open below and close above last weeks price open and close. Call it an inside day rather than an engulfing one. The ST has not changed its sentiment, but I gather it would be upon us soon with todays push lower. The only way to negate the ST from changing direction is if the price pushes back up tomorrow. Look for either a 5 wave move up tomorrow or a 3 wave move. This would tell you if the rally is impulsive or corrective. This should also set you up for a confident and structured trade. The intra-day level has turned bearish and down trending. Therefore with this scenario, the signals should not enter OS for Bulls and OB for Bears.

MT: DOWN

ST: UP

PA: NA

MT: DOWN

ST: UP

PA: NA

Friday 10 April 2015

10 Apr 2015 - Pushing The Limit?

As we enter earnings season, we are greeted with accelerating prices. I gather we are nearing an extreme in the current move which should end soon. I still consider the price action as corrective, and this does not mean that price cannot make a higher high surpassing the highs made in Late Feb. in the SPX (Early Mar. for Dow). If we do make a higher high then a push lower will just be part of a bigger corrective pattern which will eventually result in another move to higher highs. This scenario will eliminate the wave (ii) green labelled on the chart below. If price can keep below the previous ATH then wave (ii) green or 2 red is still a high possibility along with the abc corrective scenario.

Confused yet? Unfortunately, sub waves occur all the time and there is no telling or confirming until it has passed what the count actually is. The ST has remained strong to the upside and is still in OB range which called for a high risk of an acceleration up since yesterday. We could still see higher prices and since we are in OB territory, we should just let it play out until we can see the signals exit OB.

Based on my EW counts, I am speculating that a turn down is near and since I have been labelling the current moves up as second or b - waves, I am expecting an impulsive move lower that can create a wave 3 or c wave. So keep your stops close in the case you are long. For now though, the Bulls and longs are safe with the ST and PA agreeing with them.

MT: DOWN

ST: UP

PA: UP

Confused yet? Unfortunately, sub waves occur all the time and there is no telling or confirming until it has passed what the count actually is. The ST has remained strong to the upside and is still in OB range which called for a high risk of an acceleration up since yesterday. We could still see higher prices and since we are in OB territory, we should just let it play out until we can see the signals exit OB.

Based on my EW counts, I am speculating that a turn down is near and since I have been labelling the current moves up as second or b - waves, I am expecting an impulsive move lower that can create a wave 3 or c wave. So keep your stops close in the case you are long. For now though, the Bulls and longs are safe with the ST and PA agreeing with them.

MT: DOWN

ST: UP

PA: UP

Thursday 9 April 2015

9 Apr 2015 - Resistance Broken To Upside

The sideways trend this trading week has been broken to the upside. I didn't think it would ever come, but the ST has proven itself again.. If we continued the weak sideways move, I believe the ST would have eventually moved to the downside. For now the Up trend is intact.. and Intra-day Stoch. has entered OB by the end of trading hours. This raises probability of an acceleration up. We can't say for certain that anything will materialize out of the OB reading, because it will depend on how the futures performs overnight, however we must apply the risk and probability of those signals. If Intra-day signals moves out of OB then there would be less risk on acceleration in prices to the upside.

MT: DOWN

ST: UP

PA: UP

MT: DOWN

ST: UP

PA: UP

Wednesday 8 April 2015

8 Apr 2015 - Pump & Pump

The morning started with a push down but did not have enough strength to maintain its momentum from yesterday and eventually ended up in positive territory and maintained its level through the Fed Minutes. With the Fed being split on when to raise rates, I assume markets were split as well on whether to sell or to buy. Yesterdays bearish sentiment got diluted today by the SPX maintaining its price in the intra-day chart above its 75ma, and todays positive close has made a CIT on the ST. How quickly the attitudes change overnight. There was no Pump and Dump today, so with the change in ST, we should look for more upside unless the intra-day charts decides to push lower into OS territory.

MT: DOWN

ST: UP

PA: NA

MT: DOWN

ST: UP

PA: NA

Tuesday 7 April 2015

7 Apr 2015 - Bearish Advantage

The market could not hold up its positive move today even with a intra-day high. The Stoch. on the 60min chart has also now exited the OB range without any price acceleration to the upside while it was in the OB territory. This is signalling weakness, along with a voided triangular pattern that we were watching out for. I would look for intra-day trends to be in the down and accelerative position. These would confirm the bearish sentiment that we are currently setup for.

MT: DOWN

ST: DOWN

PA: DOWN

MT: DOWN

ST: DOWN

PA: DOWN

Monday 6 April 2015

6 Apr 2015 - Egg For The Bears

It looks like the horrible jobs number on Friday didn't deter any buying frenzy today. The corrective pattern I talked about last week is still valid. So look for the indicator to exit the OB range and signal a downtrend. A 2nd wave pattern is more ideal for the Bears in order to have a prolonged run to the downside while an abcde pattern provides the bulls hope that the correction lower will be met with a rebound to higher highs. With the volatility that exists it is hard for the indicator to follow in a quick manner. So either we ride out the volatility storm or stay out until the price trends in a clear direction.

MT: DOWN

ST: DOWN

PA: NA

MT: DOWN

ST: DOWN

PA: NA

Thursday 2 April 2015

2 Apr 2015 - Another Swing Getting Clearer

As the volatility swigs Up and Down we are starting to see the pattern more clearly. But we should still be careful overall. The move up in the SPX today seems to be an extension of a d-wave, but regardless of whether we are on a d-wave or e-wave, the overall picture looks to be temporarily bearish.

MT: DOWN

ST: DOWN

PA: NA

MT: DOWN

ST: DOWN

PA: NA

ALERT - High Probability Set-Up

There are 2 EW options on the ES and most likely a high probability. Both options are looking to trend lower but only one will be temporary and the other one will be super bearish. 2nd wave will be super bearish. Triangle setup will be a clue that push lower is corrective. So take advantage of both scenarios and plan your trades. Do your own DD.

Wednesday 1 April 2015

1 Apr 2015 - Did You Get April Fooled?

You probably weren't the only one. Since last night the Futures market had 4 swings. Hard to trade that even if you are good. So if you hate volatility, stay with the trend and don't panic in these conditions.

Intra-day charts started the morning with a downward direction forcing the ST to curl towards the downside but not enough to cross down unfortunately. Will have to wait till tomorrow to see what develops. Due to volatility the signals become more lagging, but clears up eventually. We should learn to trade days like these when the market does start to correct in a large way. The trend will keep you in line with your goals so a strict conviction on your trading rules are needed.

The EW pattern suggested yesterday did not materialize and evident since the start of the open. ST remains up but could open tomorrow with a cross down. Therefore trade any intra-day trend pointing down if that is the case.

MT: DOWN

ST: UP

PA: DOWN

Intra-day charts started the morning with a downward direction forcing the ST to curl towards the downside but not enough to cross down unfortunately. Will have to wait till tomorrow to see what develops. Due to volatility the signals become more lagging, but clears up eventually. We should learn to trade days like these when the market does start to correct in a large way. The trend will keep you in line with your goals so a strict conviction on your trading rules are needed.

The EW pattern suggested yesterday did not materialize and evident since the start of the open. ST remains up but could open tomorrow with a cross down. Therefore trade any intra-day trend pointing down if that is the case.

MT: DOWN

ST: UP

PA: DOWN

Subscribe to:

Posts (Atom)